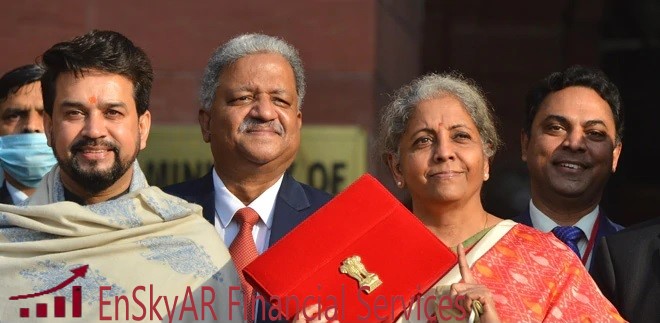

Union Budget Highlights 2021

Key Highlights of Union Budget 2021, Presented by Finance Minister Smt. Nirmala Sitharaman in the Parliament on Monday, February 01, 2021-

- Income Tax Slab- There is no change in Income Tax Slab for the financial year 2021-22.

- Relaxation to senior citizens of 75 years age and above- Senior citizens of age of 75 years or more has an option not to file their return of income if their income comprises of Pension and/or interest income only. To avail this benefit, the assesses must give a declaration to the bank where his/her income is credited. The bank shall compute tax liability and deduct the tax under section 194P. This will be applicable from 1 April 2021.

- Deduction under section 80EEA has been extended- The government has extended the additional tax deduction of Rs 1.5 lakh on interest paid on housing loan for purchase of affordable homes by one more year to March 31, 2022. This additional deduction of interest will qualify under the newly introduced section 80EEA (First Time Buyer). The tax exemption has been granted for affordable rental projects.

- Amendment to Section 44ADA- Section 44ADA applied to all the assesses being residents in India. Now onwards, it applies only to the resident individual, Hindu Undivided Family (HUF) or a partnership firm, other than LLP.

- Unit Linked Insurance Plans (ULIPs)- In case of ULIPs having annual premium more than Rs 2.5 lakh the income/return on maturity shall be treated as capital gain and charged accordingly under section 112A. Currently, the redemption of ULIPs is tax-exempt provided the total premium payable for the policy does not exceed 10% of the assured sum, but under the new proposals the redemption of ULIPs issued on or after 1 February 2021, where the annual premium payable by the individual exceeds ₹2.5 lakh would be subjected to capital gains tax.

- Exemption for Leave Travel Concession- Provide relief to employees, it is proposed to provide tax exemption to the amount given to an employee in lieu of LTC subject to incurring specified expenditure. Means the Cash Voucher Scheme launched for the central government employees has been now extended to all earning individuals.

- Reduction of time limit for completing assessment- The time limit for completion of assessment proceedings to be 9 months (earlier it was 12 months) from the end of the assessment year in which the income was first assessable.

- Reduction in time for IT Proceedings- Reopening window for IT assessment cases shall be reopened only up to three years, as the earlier time limit was six years (means reduced from 6 years to 3 years). However, Except in case of serious tax evasion cases (Rs. 50 lakh or more), it can go up to 10 years.

- Constitution of Dispute Resolution Committee for small and medium taxpayers to reduce number of disputes- Those for small and medium taxpayers assessed with a taxable income of up to Rs.50 lakh and any disputed income of Rs.10 lakh can approach this committee under section 245MA.

- Faceless proceeding before the Income Tax Appellate Tribunal - Provision is made for faceless proceedings before the Income Tax Appellate Tribunal (ITAT) in a jurisdiction less manner. It will reduce the cost of compliance for taxpayers, and increase transparency in the disposal of appeals.

- Tax incentives to startups- The tax holiday for startups has been extended by one more year up to 31st March 2022. Further, the capital gains exemption for startups has also been extended by another year.

- Advance Tax on dividend income- Advance tax will henceforth be applicable on dividend income only after its declaration/payment. The dividend paid to Real Estate Infrastructure Trusts or Infrastructure Investment Trusts (REIT/InvIT) shall be exempt from TDS. Tax holidays are proposed for aircraft leasing and rental companies.

- Disallowance of late deposit of Employee’s PF contribution- No deduction to be allowed for the employee’s contribution to the welfare schemes if they are not deposited within the specified due date means late deposit of employees’ EPF contribution by the employer shall never be allowed as income tax deduction to the employer.

- Interest on Contribution to recognized provident fund- No exemption for interest accrued during the previous year on the recognized provident fund to the extent it relates to the contribution in excess of Rs. 250,000 in a previous year.

- Reduction of time limit for completing assessment- The time limit for completion of assessment proceedings to be 9 months (previously 12 months) from the end of the assessment year in which the income was first assessable.

- Reduction of time limit for filing of Belated/Revised Returns - It has proposed to reduce the last date of filing of belated or revised returns of income by three months. before the end of the relevant assessment year or before the completion of the assessment, whichever is earlier, means deadline for filing belated/revised ITR from March 31 of the relevant assessment year to December 31 of the assessment year. The above-proposed changes will be effective from April 1, 2021 and accordingly apply for the assessment year 2021-22 and the subsequent assessment years.

- Depreciation on Goodwill – No depreciation allowed on goodwill of a business or profession and to be taxed as capital gains on transfer. However, the deduction for the amount paid for acquiring goodwill shall be allowed on sale of goodwill.

- Pre-filled ITR forms- ITR form will now have pre-filled information on dividend, interest and capital gains to ease compliance for individual taxpayers. Details of capital gains from listed securities, dividend income, and interest from banks, post office, etc. will also come pre-filled. Details of salary income, tax payments, TDS, etc will also be there in ITR forms.

- Higher TDS for non-filers of income tax returns- The government has proposed to levy higher Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) on non-filers of income tax return. New section 206AB for a higher rate for TDS and under section 206CCA for a higher rate of TCS in the Income Tax Act as a special provision providing. The proposed TDS rate in this section will have twice the rate specified in the relevant provision of the Act, or twice the rate or rates in force, or the rate of 5%.

© 2024 - EnSkyAR Financial Services