How to Pay Taxes Online

Introduction-

Here we discuss about step by step guidance about how to pay taxes online.

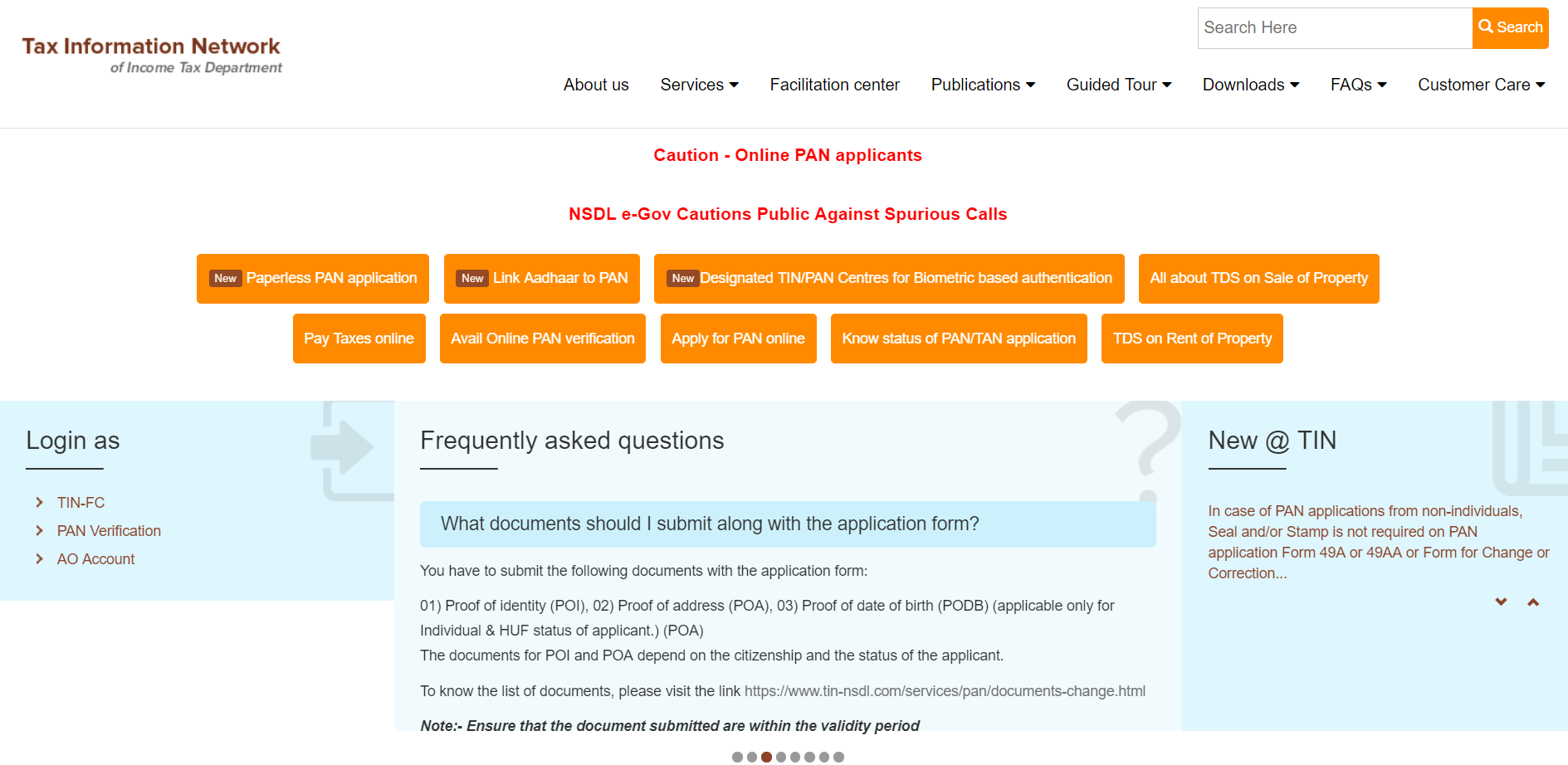

- Login to http://www.tin-nsdl.com

- Next, go to “Services” as the screen will display as below-

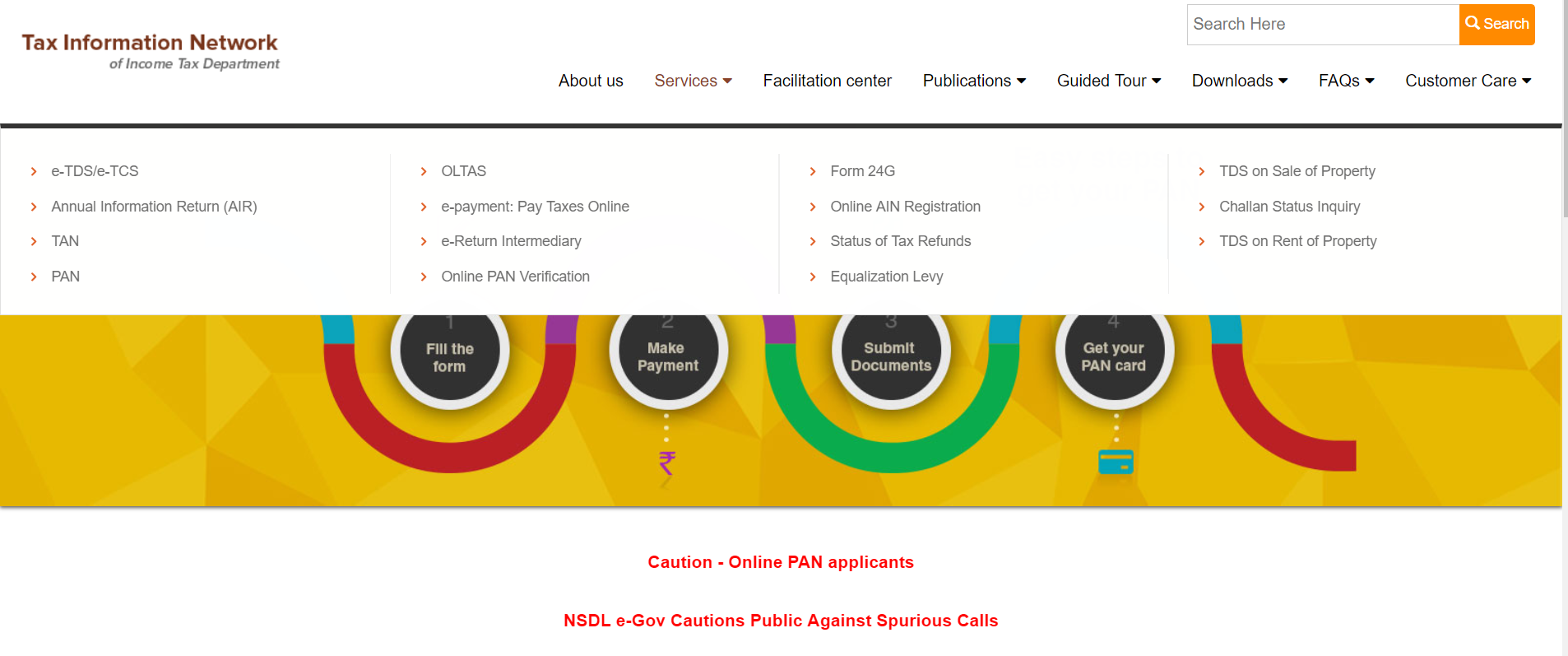

- Next, go to “e-payment: Pay Taxes Online” or click there as the screen will display as below-

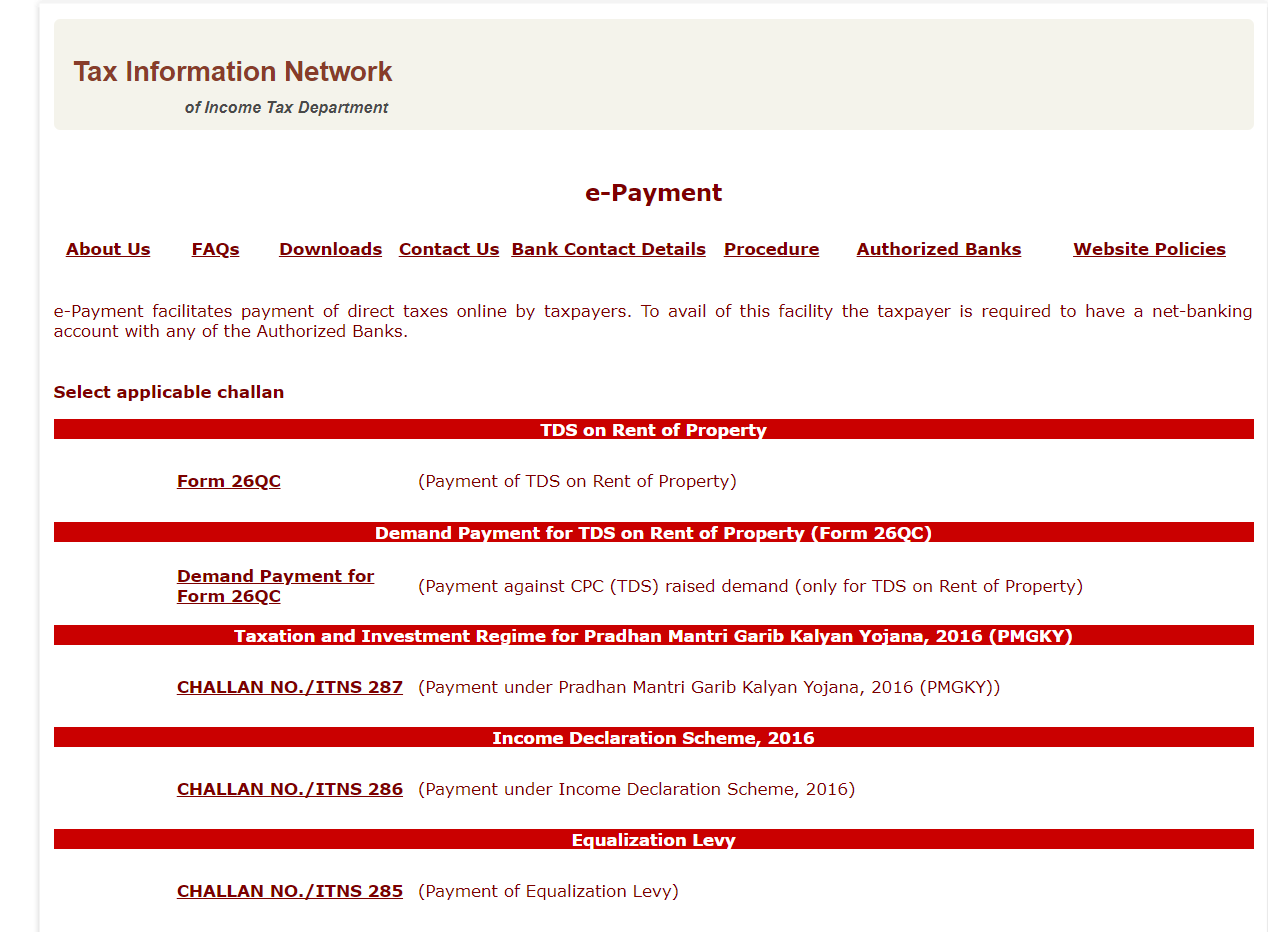

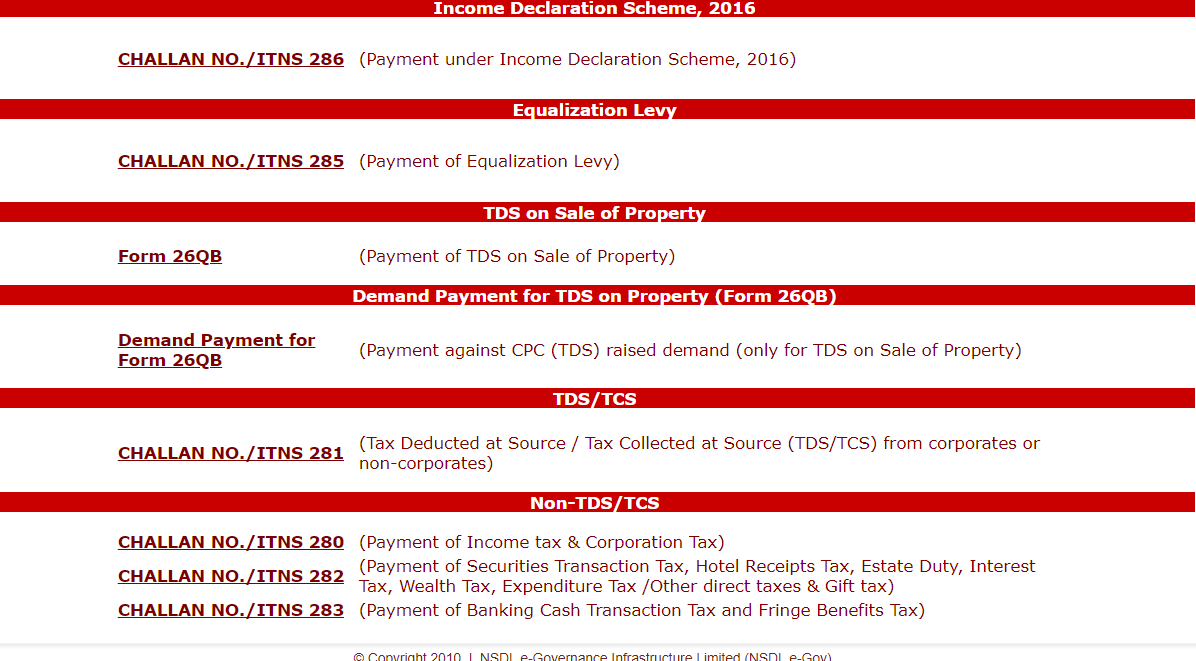

- Next, Select the relevant challan under which payment has made as shown below –

|

Form No.

|

Particulars

|

|

Form 26QC

|

Payment of TDS on Rent of Property

|

|

Demand for form 26QC

|

Payment against demand raised by CPC on TDS on Rent of Property

|

|

ITNS 287

|

Payment under Pradhan Mantri Garib Kalyan Yojana, 2016 (PMGKY)

|

|

ITNS 286

|

Payment under Income Tax Declaration Scheme, 2016

|

|

ITNS 285

|

Payment of Equalization levy

|

|

Form 26QB

|

Payment of TDS on Sale of Property

|

|

Demand for form 26QB

|

Payment on Demand raised by CPC on Sale of Property

|

|

ITNS 281

|

TDS/TCS deducted from Corporate or Non-Corporate Assessees

|

|

ITNS 280

|

Payment of Income Tax/ Corporation Tax

|

|

ITNS 282

|

Payment of Estate Tax, Gift Tax & other direct taxes

|

|

ITNS 283

|

Payment of Banking Cash Transactions

|

Select the above, As the screen will display as below-

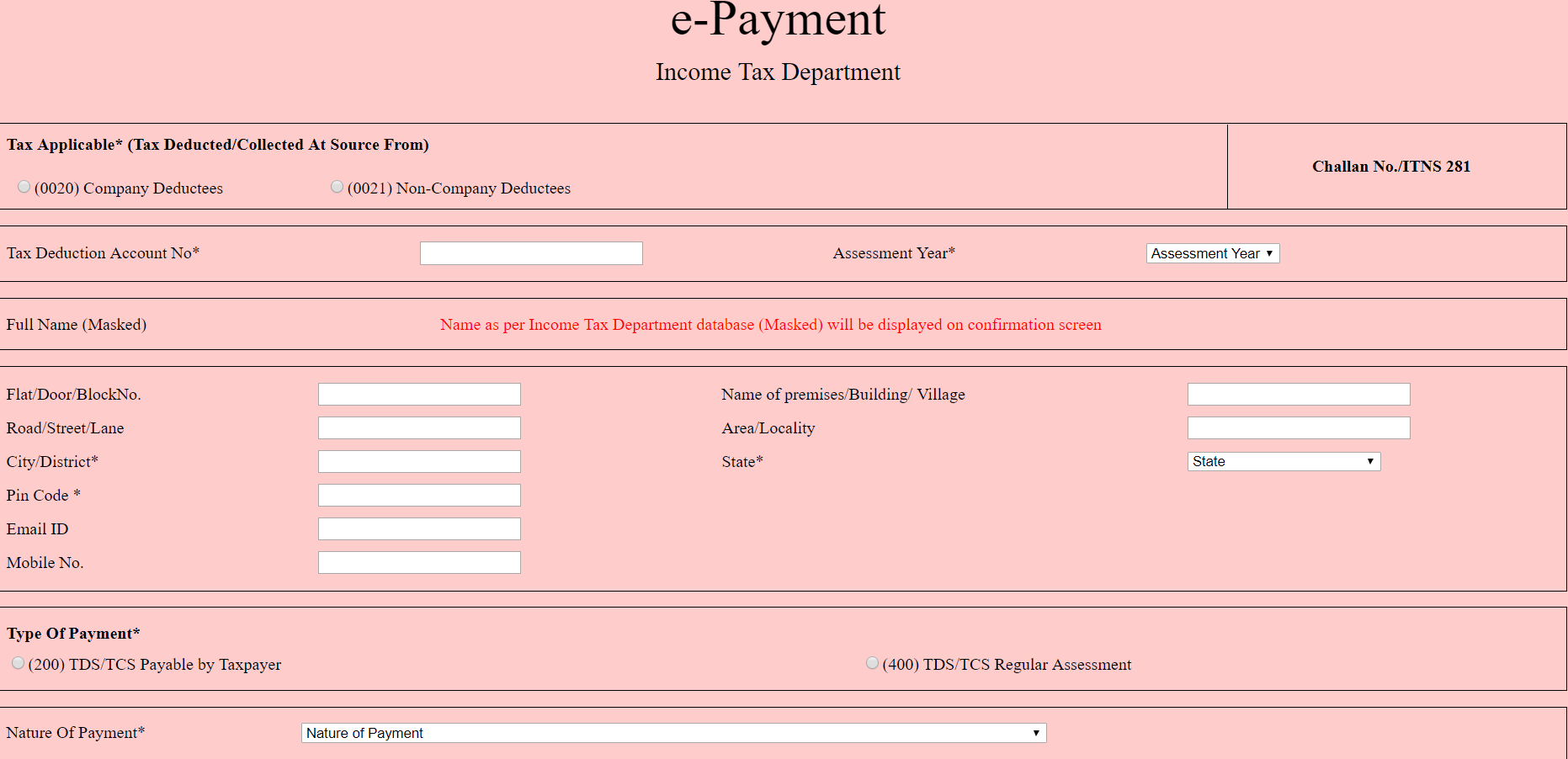

- Next, Fill the proper details like Tax applicable, TAN number, Name & Address, Type of payment, Nature of payment, Mode of payment & Captcha, as the specimen given below-

- Next, after submission of the aforesaid date the screen will display the PAN / TAN is valid as per the ITD PAN / TAN master, then the full name of the taxpayer as per the master will be displayed on the confirmation screen.

- Next, on confirmation of the data so entered, the taxpayer will be directed to the net-banking site of the bank.

- Next, the taxpayer has to login to the net-banking site with the user id / password provided by the bank for net-banking purpose and enter payment details at the bank site.

- On successful payment a challan counterfoil will be displayed containing CIN, payment details and bank name through which e-payment has been made.

- This counterfoil is proof of payment being made.

© 2024 - EnSkyAR Financial Services