Assets-

Anything which is in the possession or is the property of business enterprises including the amount due to it from others is called an asset. Cash and Bank balances, Stocks, Furniture, Machinery, Land and Building, bills Receivable, Money owing by Debtors etc. are comes under the category of Assets.

“Assets are future economic benefits, the rights of which are owned or controlled by an organization or individual”- Finney &Miller

“Assets are valuable resources owned by a business which are acquired at a measurable money cost” - Prof. R.N. Anthony

Classification of an Assets-

1. Non-Current Assets-

Non-Current Assets are those assets which are held for continued use in the business for the purpose of producing goods or services and are not meant for sale. Non-Current Assets are long term investments and fixed assets are as under-

- Land and Building

- Plant & Machinery

- Equipment

- Computer

- Motor Vehicle

- Furniture

- Patents

- Trademark etc.

Fixed Assets are further classified into-

- Tangible Assets- Tangible assets are those assets which can be seen and touched. Those assets which have a physical existence such as Land & Building, Plant & Machinery, Equipment, Computer, Motor Vehicles, Furniture, Stock, Cash etc.

- Intangible Assets- Intangible assets are those assets which do not a physical existence and thus. Cannot be seen or felt such as Goodwill, Patents, Copyright, Trade Marks, Computer Software and Prepaid Expenses, Intangible assets are also valuable assets. Intangible assets help the firm in earning profits as much as the tangible assets. Tangible assets and Intangible assets are valuable assets.

2. Current Assets-

Current Assets are those assets which are meant for sale or which the management would want to convert into cash with one year, such are as under-

- Cash in hand

- Cash at Bank

- Debtors

- Bills Receivable

- Short term Investments

- Prepaid expenses etc.

Current assets are usually shown in the balance sheet in the “Liquidity Order.” Liquidity is the facility with which the assets may be converted into cash. Stock and Investments are shown in the balance sheet at Cost or Realisable value whichever is less. Bills Receivable and Debtors are shown at the estimated realisable value and the Cash in hand and Bank balance are shown at the actual figures.

3. Fictitious or Normal Assets-

Fictitious or Normal Assets are the assets which cannot be realized in cash or no further benefit can be derived from these assets. Such assets include Debit balance of P&L A/c and these are unwritten losses or non-recoupable costs. For instance, underwriting commission, Brokerage, Discount on Issue of Shares or Debentures etc. These assets are not really assets but are shown on the Assets side only for the purpose of transferring them to the Profit & Loss Account gradually over a period of time.

Liabilities-

Liabilities are the amounts which a business has to pay. They are generally classified according to the period for which they are contracted. Certain liabilities are repayable within a short period of time while certain other liabilities are repayable only after a long time.

“Liabilities are debts, they are amounts owned to Creditors” – Finney and Miller

Classification of an Liabilities-

1. Non-Current Liabilities-

Non-current liabilities which fall due for payment in a relatively long period say more than one year, such are as under-

- Long term loans

- Debentures

- Mortgage payable

- Deferred tax liability

2. Current Liabilities-

Current Liabilities refer to those liabilities which are to be paid in near future, usually within a year, such are as under-

- Sundry Creditors

- Bank overdraft

- Bills Payable

- Outstanding expenses

- Short term loans etc.

3. Contingent Liabilities-

The liabilities which are not the liabilities of the firm on the date of the Balance Sheet but may become liabilities in future on happening of an uncertain event are all called contingent liabilities, such are as under-

- Law suit which is pending in the court of law, if lost, may create a liability.

- Bills discounted with a bank are also a contingent liability, if the acceptor fails to meet the bill.

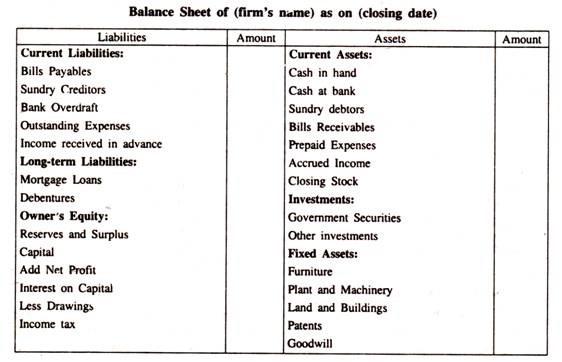

Specimen Performa of Assets & liabilities-