Introduction-

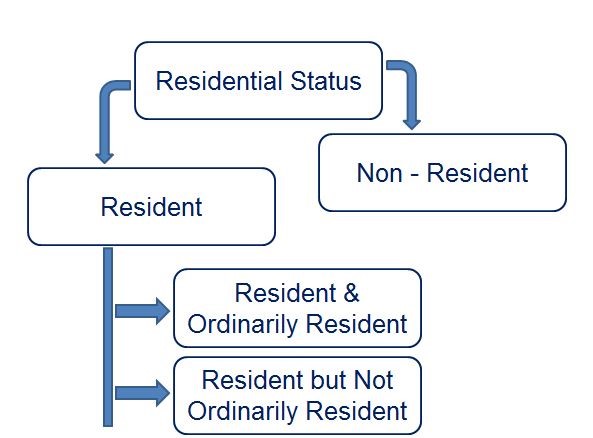

Residential status of an Individual & HUF for Income Tax purpose, If a person is a resident of India, he has to pay taxes to the Income Tax Department and if not, then he is not liable to pay any taxes to the aforesaid authority. So to calculate tax as per Income Tax Act, we have to determine the residential status.

1. Residential Status of an Individual {Section 6 (1)}-

(i) An Individual is said to be “Resident” in India-

An individual is said to be resident in India in any previous year, if an individual satisfies any one of the following conditions, if—

(1) He is in India for a period or periods amounting in all to 182 days or more in the relevant previous year;

or

(2) He is in India for 60 days or more during the relevant previous year and has been in India for 365 days or more during 4 previous years immediately preceding the relevant previous year.

Example 1-

Mr. Ram stayed in India from 01st May 2017 to 15th August 2017, 1st December 2017 to 18th February 2018. What is the status of his for the financial year 2017-2018?

Answer-

Total no of days =

|

Period

|

No. of Days

|

|

1st May 2017 to 15th August 2017

|

= 31 + 30 + 31 + 15 = 107 days

|

|

1st December 2017 to 18th February 2018

|

= 31 + 31 + 18 = 80 days

|

|

Total number of days during the previous year

|

= 107 + 80 = 187 days.

|

Mr. Ram stayed in India during the previous year 2017-18 for 187 days (Full fill the condition of 182 days or more during the relevant previous year).

So, Mr. Ram is said to be Resident in India for the financial year 2017-18.

Example 2-

Mr. Ram stayed in India as below-

- 1st May 2017 to 15th August 2017.

- 1st July 2016 to 18th September 2016

- 18th April 2015 to 22th July 2015

- 1st December 2014 to 25th March 2015

What is the status of his for the financial year 2017-18?

Answer-

Total no of days =

|

Period

|

No. of Days

|

|

1st May 2017 to 15th August 2017

|

= 31 + 30 + 31 + 15 = 107 days

|

|

1st July 2016 to 18th September 2016

|

= 31 + 18 = 49 days

|

|

18th April 2015 to 22th July 2015

|

= 18 + 31 + 30 + 22 = 101 days

|

|

1st December 2014 to 25th March 2015

|

= 31 + 31 + 28 + 25 = 115 days

|

|

Total number of days during the 4 years immediately preceding the relevant previous year

|

= 107 + 49 + 101 + 115 = 372 days.

|

Conclusion-

- Ram stayed in India during the previous year 2017-18 for 107 days (Full fill the condition of 60 days or more during the relevant previous year).

- Total number of days during the 4 years immediately preceding the relevant previous year = 372 days (Full fill the condition of 365 days or more during the 4 years immediately preceding the previous year)

So, Mr. Ram is said to be Resident in India for the financial year 2017-18.

Keep in Mind the following points-

- Incomputing the period of 182 days, the day the individual enters India and the day he leaves India should both be treated as stay in India.

- In computing the period of stay in India, it is not necessary that the stay should be for a continuous period.

- Place and purpose of stay inIndia is immaterial. It is also not necessary that the stay should be only at one place.

Explanation 1—there are two exceptions to the above rules-

- In case of an individual, who is a citizen of India and who leaves India in any previous year for the purposes of employment outside India or as a member of the crew of an Indian ship, the second condition stated as above shall not be applicable for the relevant previous year in which he leaves India.

- In case of an individual, who is a citizen of India, or is a person of Indian origin, who, being outside India, comes on a visit to India in any previous year, the second condition stated above shall not be applicable. In other words, he shall not be a resident in India unless his stay in India is at least 182 days during the relevant previous year in which he visits India.

Explanation 2—For the purposes of this clause, in the case of an individual, being a citizen of India and a member of the crew of a foreign bound ship leaving India, the period or periods of stay in India shall, in respect of such voyage, be determined in the manner and subject to such conditions as may be prescribed.

(ii) An Individual is said to be “Resident but not Ordinarily Resident” in India-

An individual who is resident in India shall be Resident but not ordinarily in India, if he satisfies both the following conditions i.e. -

- He has been a resident of India in at least 2 out of 10 years immediately previous years and

- He has stayed in India for at least 730 days in 7 immediately preceding years.

(iii) An Individual is said to be “Non Resident” in India i.e. NRI {Section 2 (30)}-

If none of the above conditions is satisfied, he is said to be a Non Resident Indian (NRI).

(2) Residential Status of an HUF {Section 6 (2)}-

(i) An HUF is said to be “Resident” in India

An Hindu undivided family (HUF) is said to be resident in India in any previous year in every case except where during that year the control and management of its affairs is situated wholly outside India.

(ii) An HUF is said to be resident and ordinarily resident in India-

An HUF is said to be resident and ordinarily resident in India, if the karta of the HUF satisfies both the following conditions i.e. -

(a) He has been a resident of India in at least 2 out of 10 years immediately previous years and

(b) He has stayed in India for at least 730 days in 7 immediately preceding years.

(iii) An HUF is said to be resident but not ordinarily resident in India-

An HUF, which is resident in India, is said to be resident but not ordinarily resident in India during the relevant previous year, if the manager (Karta) of the HUF does not satisfy any one, or both, of the conditions mentioned in clauses (a) and (b) above.

(iv) An HUF is said to be Non Resident-

A HUF is said to be non-resident in India if during the previous year, the control and management of its affairs is situated wholly outside India.

(3) If a person is resident in India in a previous year relevant to an assessment year in respect of any source of income, he shall be deemed to be resident in India in the previous year relevant to the assessment year in respect of each of his other sources of income.

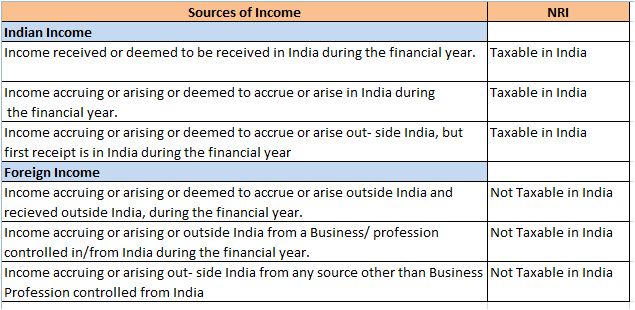

Taxability-

Resident- A resident will be charged to tax in India on his global income i.e. income earned in India as well as income earned outside India.

Non Resident and Resident Not Ordinarily Resident- Their tax liability in India is restricted to the income they earn in India. They need not pay any tax in India on their foreign income.