How to E-file GSTR-1

GSTR-1 is a monthly or quarterly return that should be filed by every registered dealer. Now, I am telling about

GSTR 1, how you can file it-

- First, Login at www.gst.gov.in

- Next, Login with Username & Password

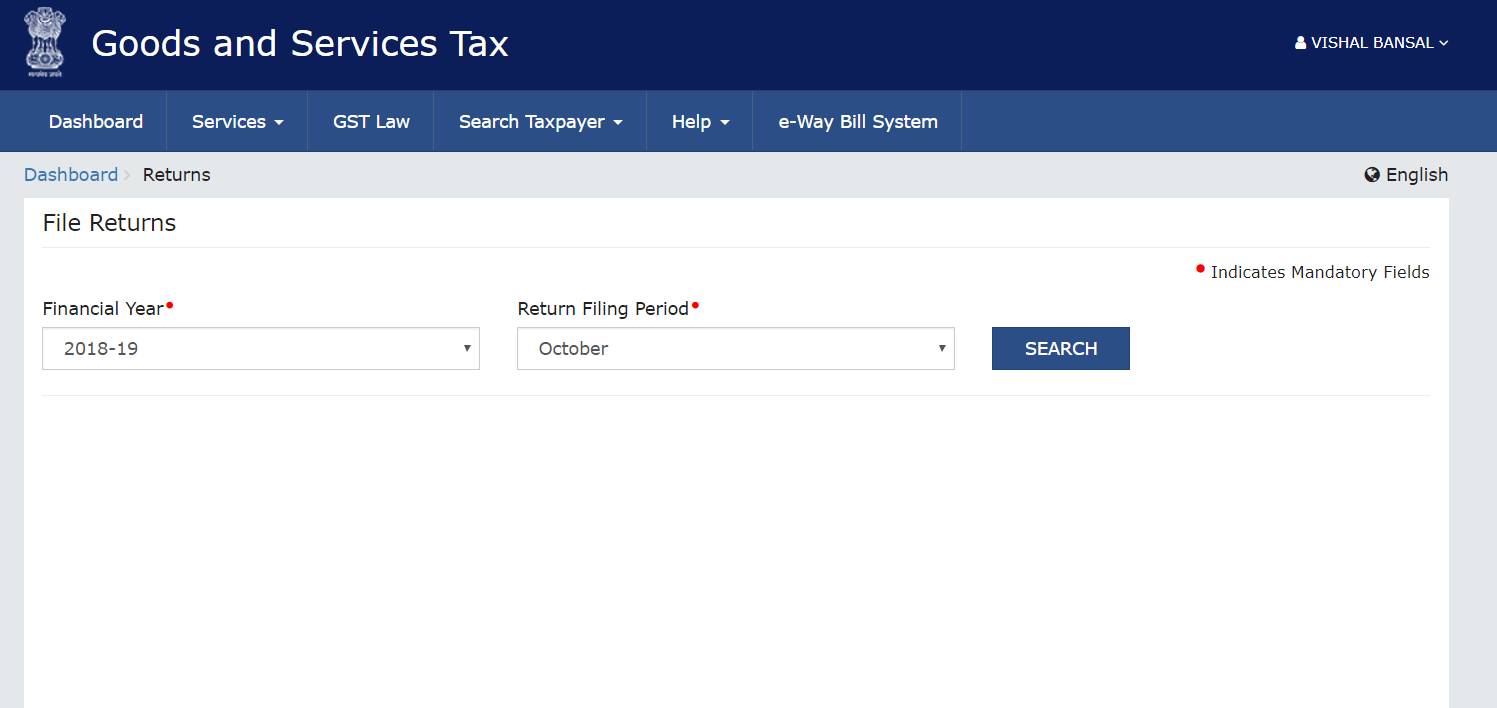

- Next, go to “Dashboard” and click on “File Returns”

- Next, the screen will display as below then select Financial year or Return filing period-

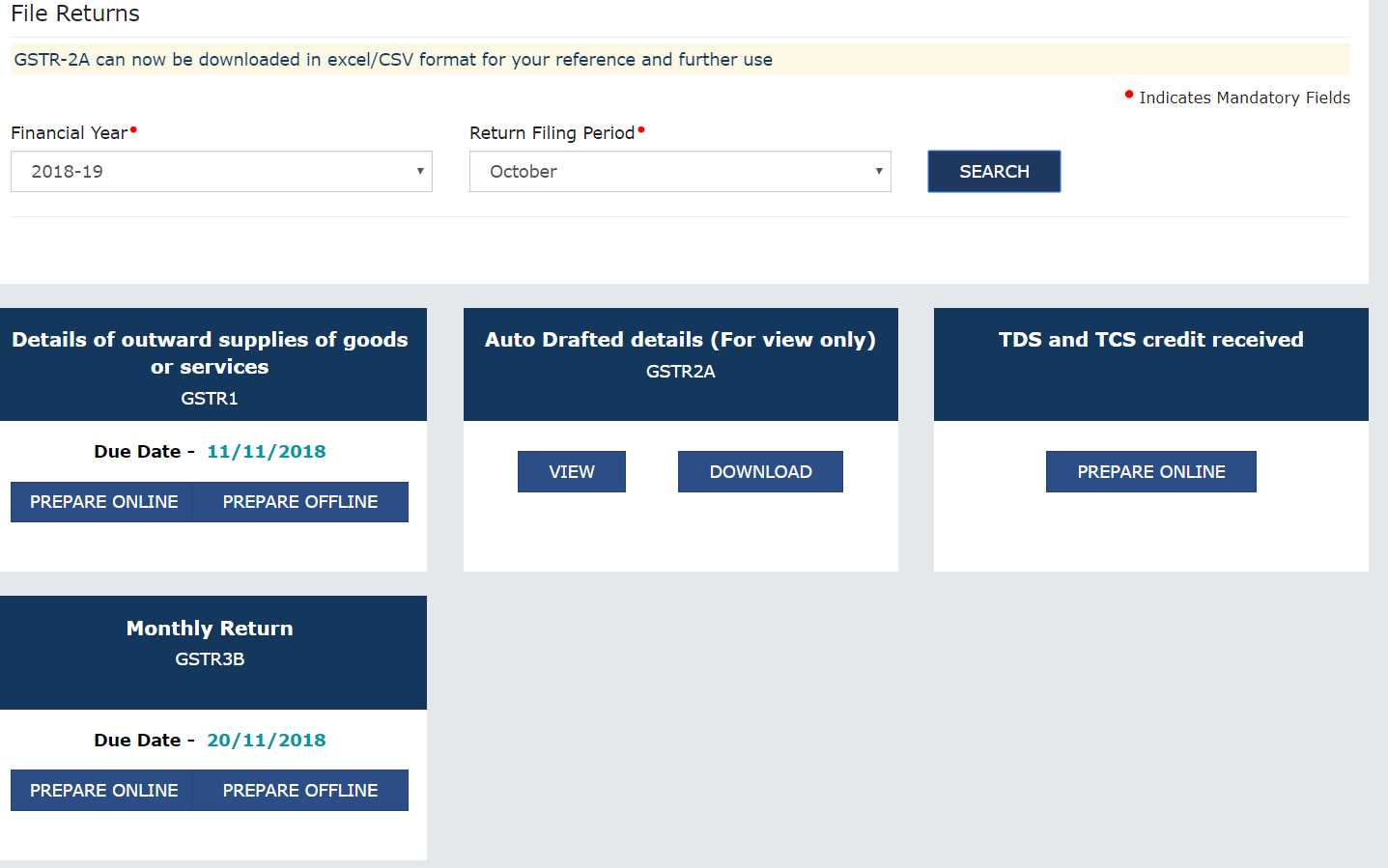

- Next, the screen will display as below, select “GSTR-1” to file your return, you can file online or through offline-

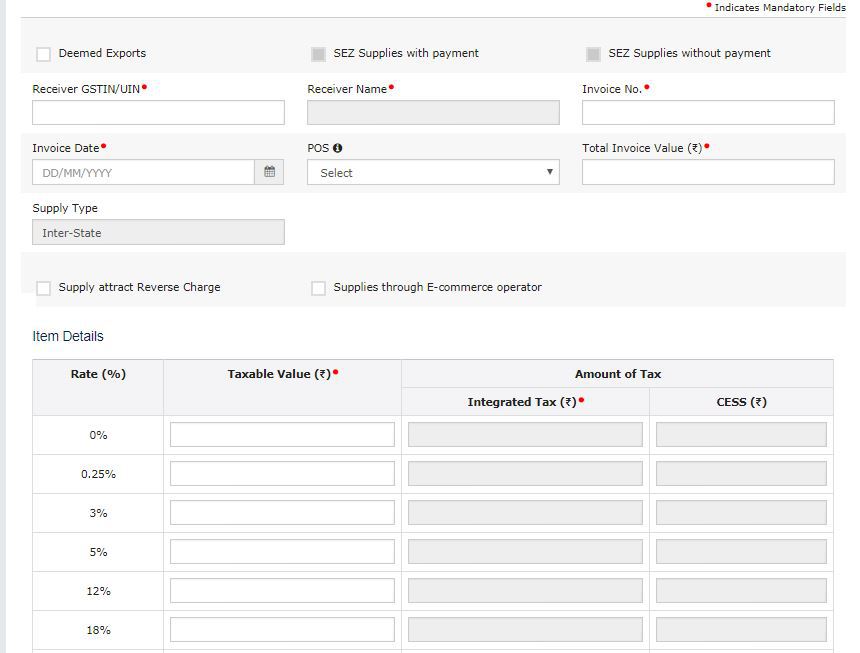

- Next, the screen will be display as below, fill the bill wise details of taxable supply to registered dealer (B to B) (including UIN) (In Table 4A, 4B, 4C & 6C)-

- 4A – Supplies other than those (i) attracting reverse charge and (ii) supplies made through e-commerce operator– This means the above-mentioned details for normal taxable supplies.

- 4B – Supplies attracting tax on reverse charge basis – This means the above-mentioned details for Supplies made under Reverse Charge.

- 4C – Supplies made through e-commerce operator attracting TCS (operator wise, rate wise) – This means the above-mentioned details for Supplies made by way of an E-Commerce operator. In addition to above it would also require GSTIN of e-commerce operator.

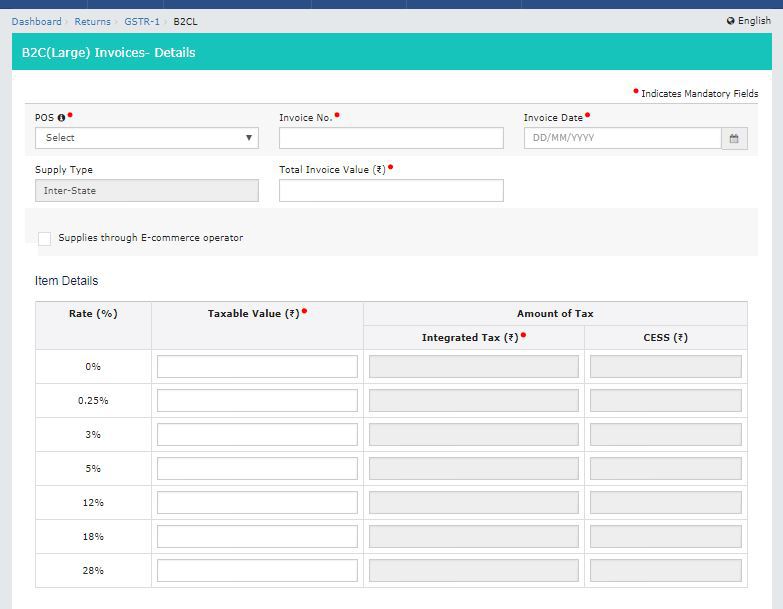

- Next, the screen will be display below, fill the bill wise details of interstate supply to unregistered dealer (B to C) if the value of invoice is above to Rs. 2,50,000/- (if any in table 5A & 5B)-

- This will include B2B invoices i.e. sale to unregistered dealer and

- The details of B2C supplies made online through e-commerce operator

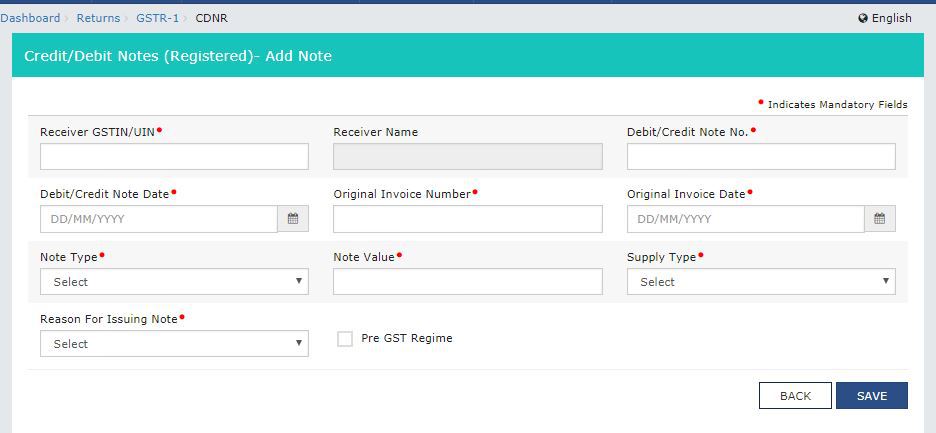

- Next, the screen will be display as below, fill the details of debit or credit notes issued to registered dealers (if any in table 9B)-

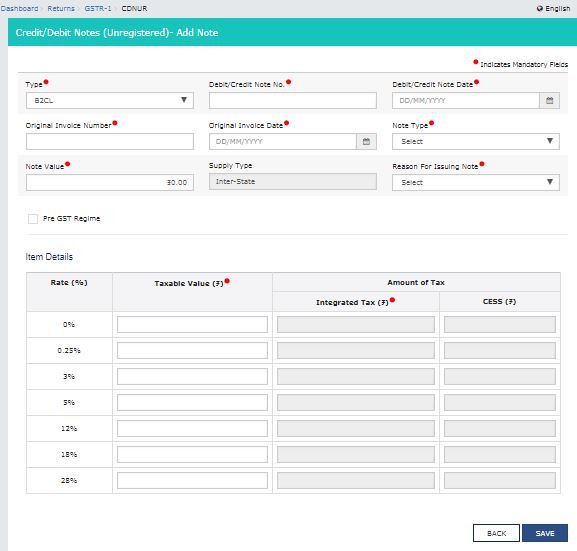

- Next, the screen will be display as below, fill the details of debit or credit notes issued to unregistered dealers (if any in Table 9B)-

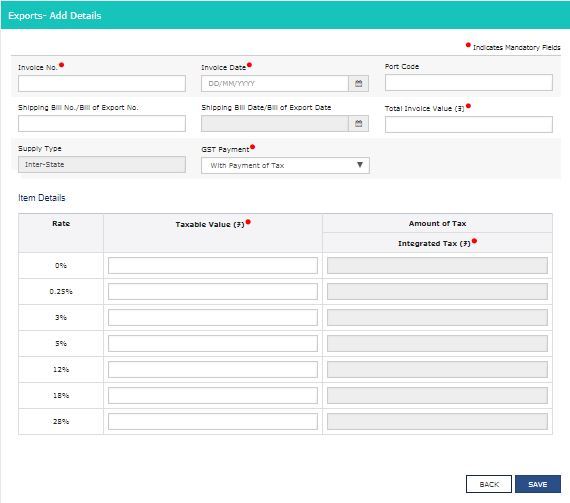

- Next, the screen will be display as below, fill the details of supply by way of export, deemed exports, export made to SEZ unit (if any in Table 6A)-

- Next , Amendment to details of outward supplies to registered persons (B to B), Unregistered persons (B to C), Export supplies, of earlier tax periods (if any in table 9A)-

- Next, Amendment to credit/debit notes issued to registered persons (B to B), Large Unregistered persons (B to C), of earlier tax periods (if any in table 9C)-

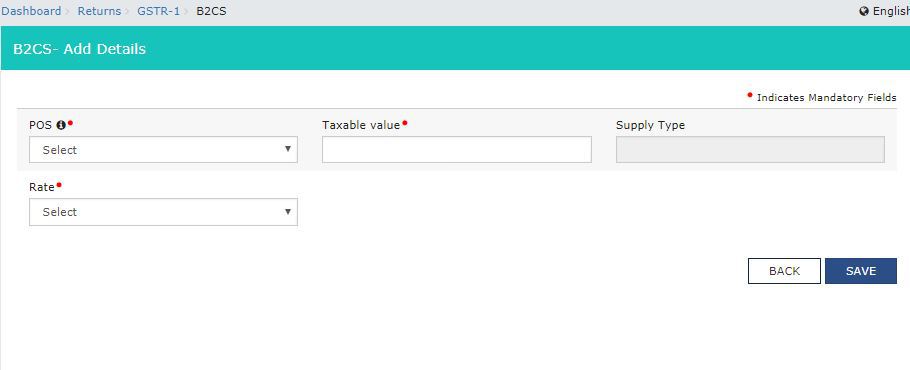

- Next,the screen will be display as below, fill the details of supply (Net of Debit/Credit notes) to unregistered persons (B to C) (if any in table 7) other than supplies above (if any in table 5)-

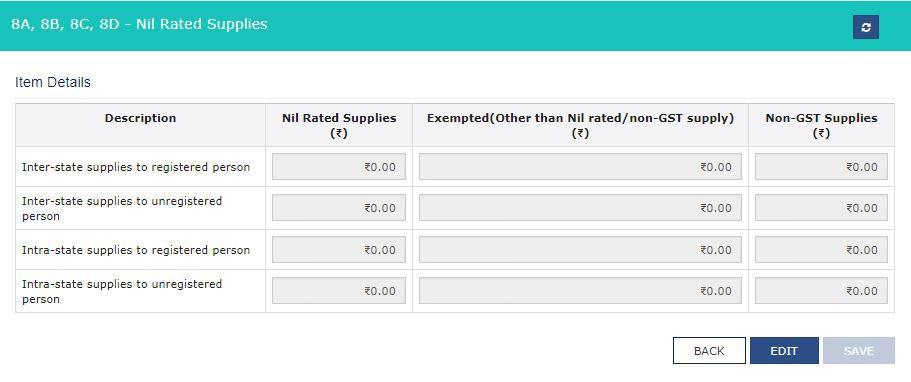

- Next, the screen will be display as below, fill the details regarding NIL rated, exempted or non-GST supplies (if any in table 8A, 8B, 8C & 8D)-

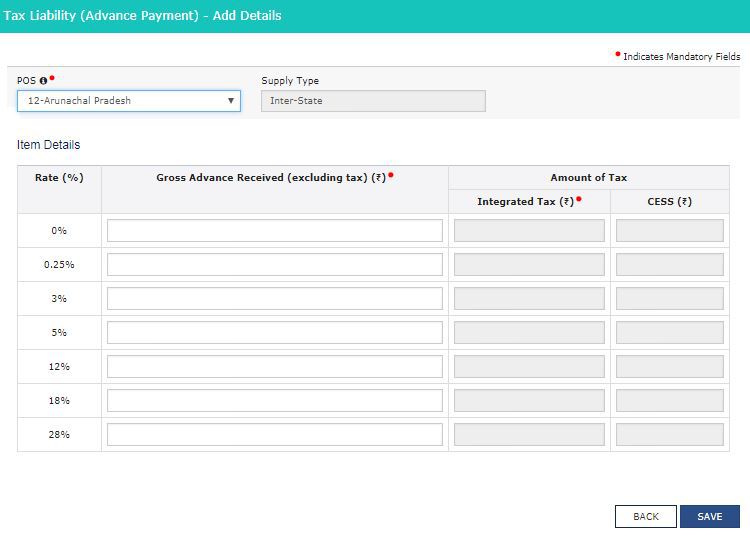

- Next, the screen will be display as below, fill the details regarding tax liability for Advances received (if any in table 11A (1) & 11A (2)-

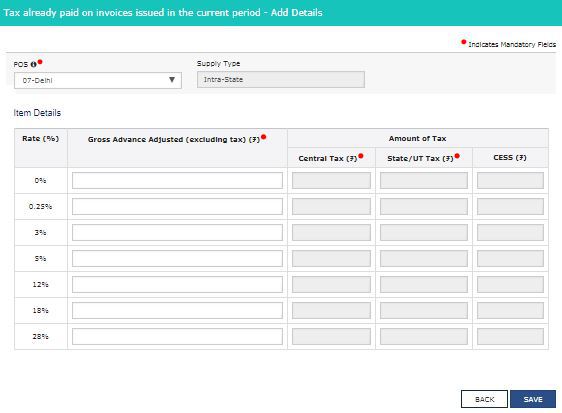

- Next, the screen will be display as below, adjusting the advance received in this tax period (if any in table 11B (1) & 11B (2) and adjusted against supply as above (if any in table 4, 5, 6 & 7)-

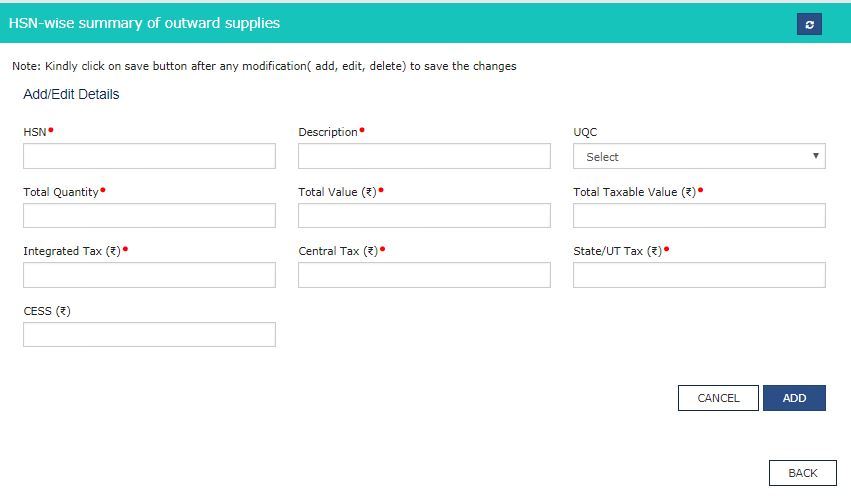

- Next, the screen will be display as below, fill the detail of HSN wise outward supply (in table 12)-

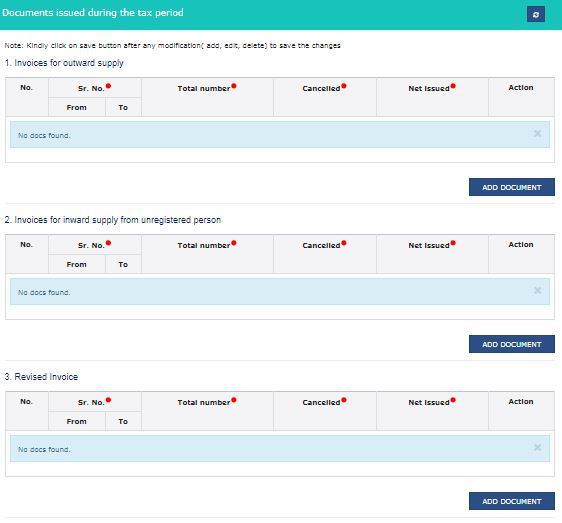

- Next, the screen will be display as below, fill the invoice details issued against outward supply (in table 13)-

- Next, acknowledge the declaration and submit.

- At Last, click on “File Return” and attached the DSC or EVC as you have.

See related posts : GSTR 9 Annual Return for Normal Registered Taxpayers

© 2024 - EnSkyAR Financial Services