How to E- file Income Tax Return

Introduction-

How to E file Income Tax Return- Before filing your Income Tax Return, you have to kept the following details-

- Income details for the financial year for which year the return has filed. For example-

- Investment details for the financial year under section 80 (if any).

- Bank account detail for ex. Bank account number, IFSC code, etc.

- Your TDS details like Advance tax deposited, TDS deducted by third party (if any) or self-assessment challan deposited (if any), reconciliation with form 26AS.

- your login details like PAN number and password etc.

- Your Aadhar number.

After preparing the details as above, you also note that the standard deduction introduced for salaried persons/pensioners w.e.f 01.04.2018, now, we are ready for e-filing of Income tax return, step by step as given below-

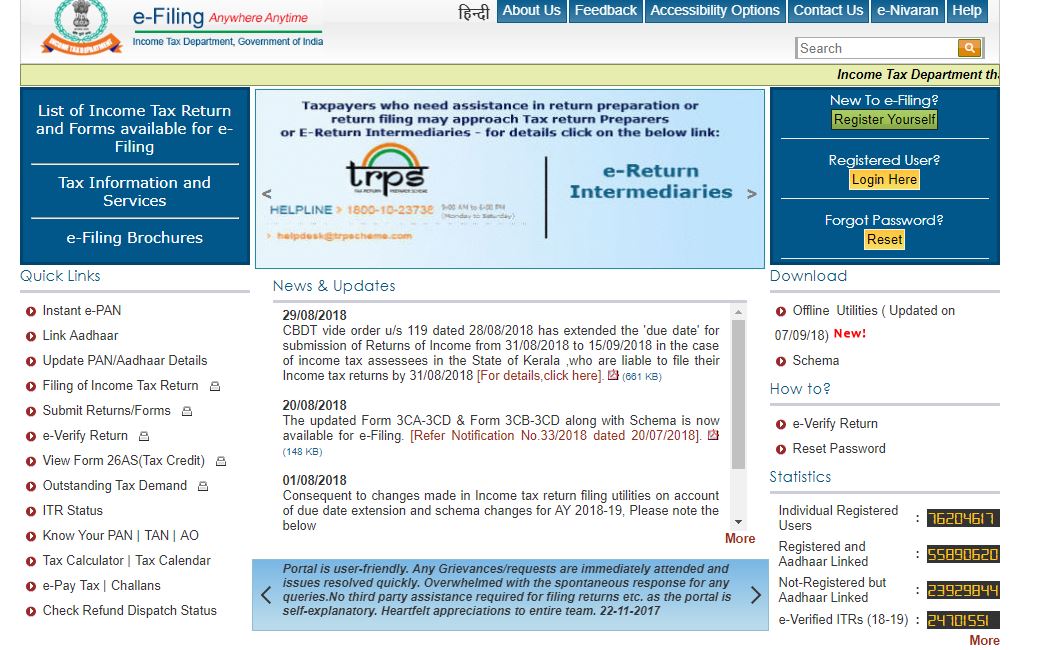

- Login to https://www.incometaxindiaefiling.gov.in

- After login the above link, the screen will be displayed as under-

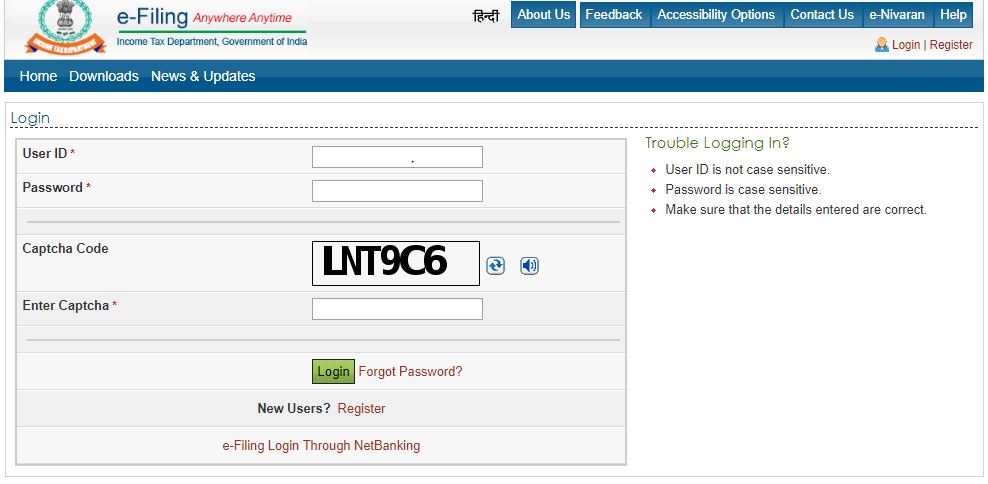

- Next step, if you are already registered, you have to login as registered user or otherwise first you have to register yourself. After login the screen will be displayed as under-

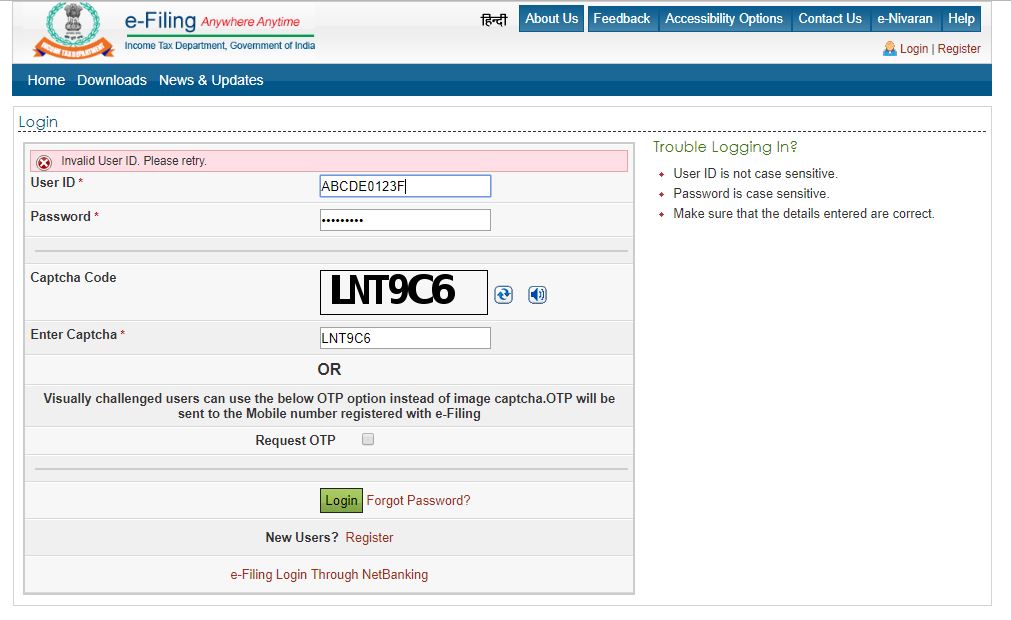

- Next step, Fill your user id (Pan Number), then your password, then captcha code shown above (LNT9C6) then enter login, as shown below-

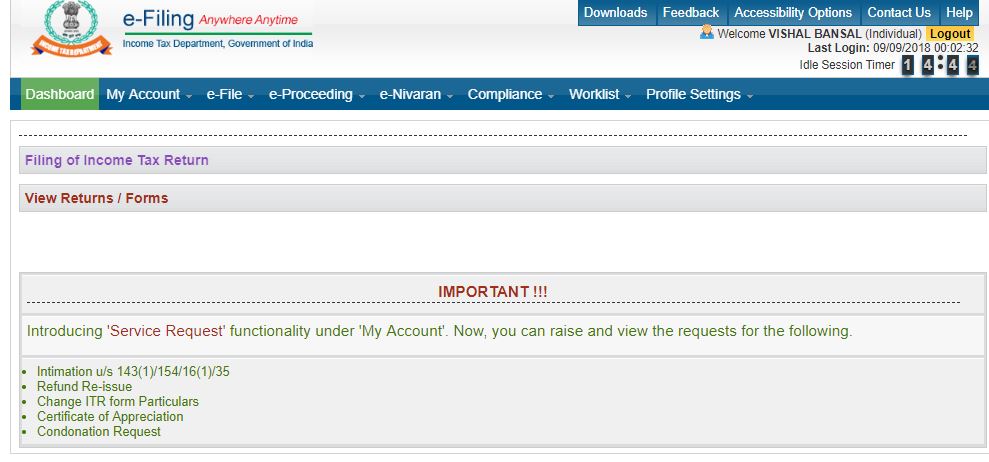

- Next step, the screen will be displayed as under-

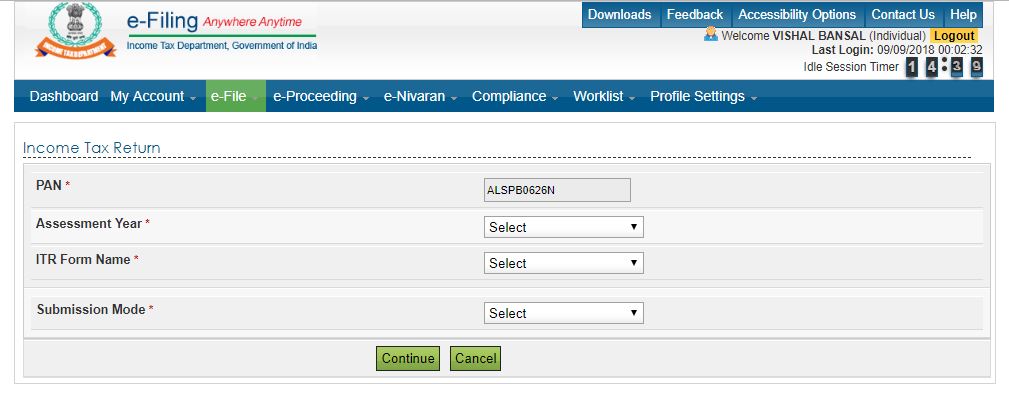

- Next step, then you have to go e-file, then fill the Assessment year for example return for the F.Y. 2017-18, Assessment year will be 2018-19, then file form ITR-1 , ITR-2, ITR-3, ITR-4, ITR-5 etc., submission mode will displayed first UPLOAD XML OR PREPARE AND SUBMIT ONLINE.

If you are filing ITR-1 or ITR-4, you can go for PREPARE AND SUBMIT ONLINE.

If you are filing ITR-2, ITR-3 or ITR-5 you have to file through UPLOAD XML FILE, XML file will be prepared manually download the ITR form on excel sheet, filing your details then you have to generate XML file or upload it.

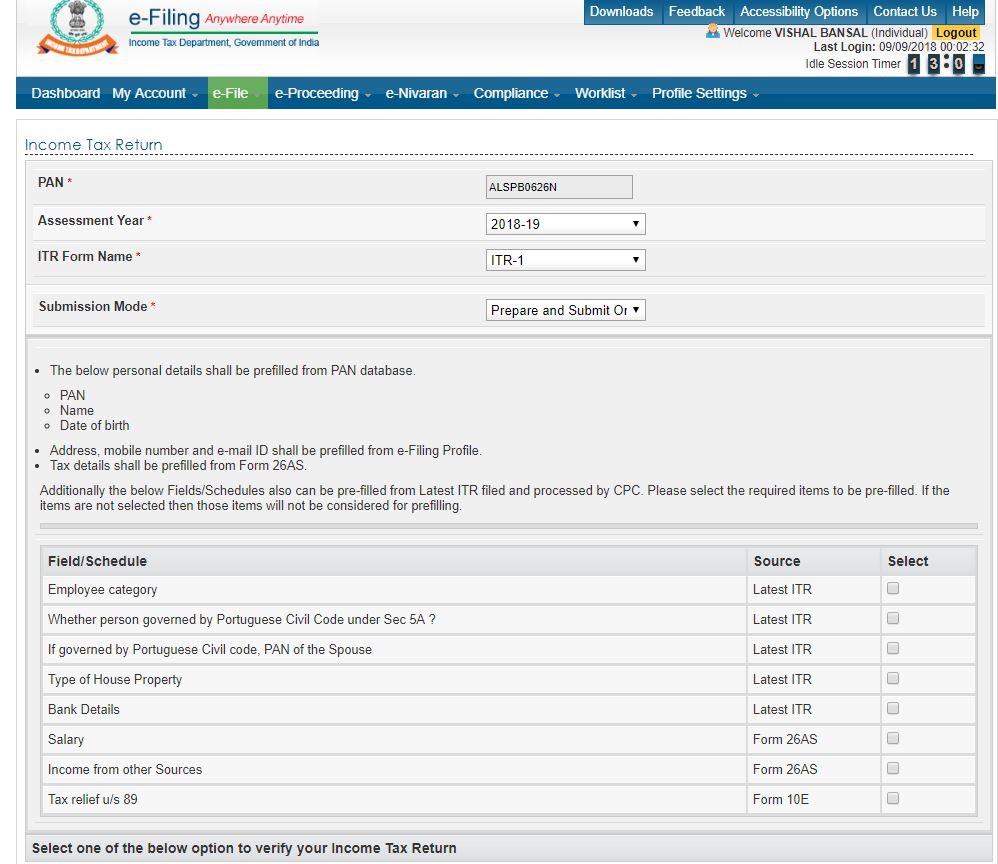

- Next step, after submission, the scrren will be displayed as under, select the field below or go to continue-

- Next step, Go to Part A General Information as display below-

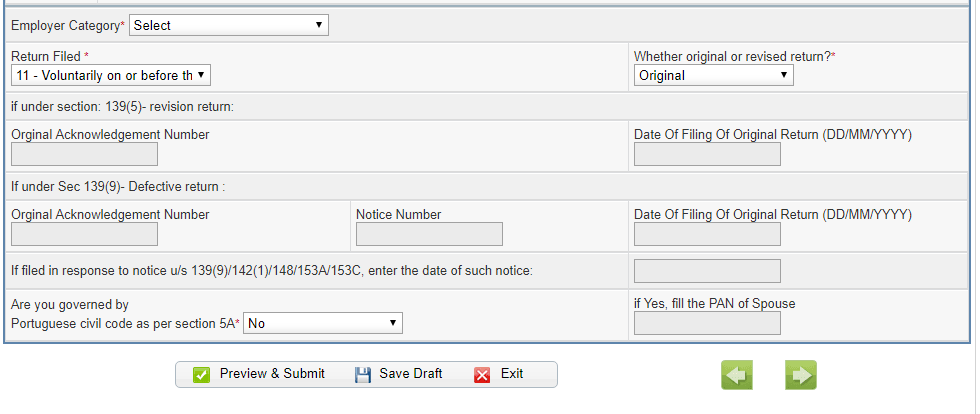

- Next step, fill the detail shown below, like employer category, whether Original or Revised return, or Return filed on or before the due date or after the due date etc.

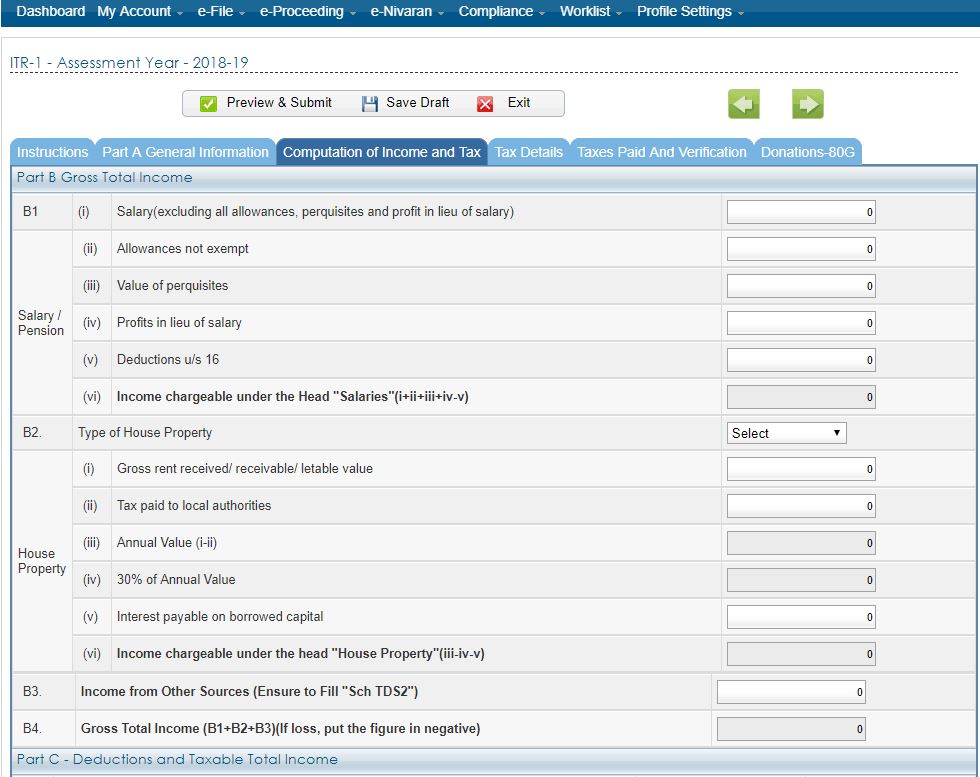

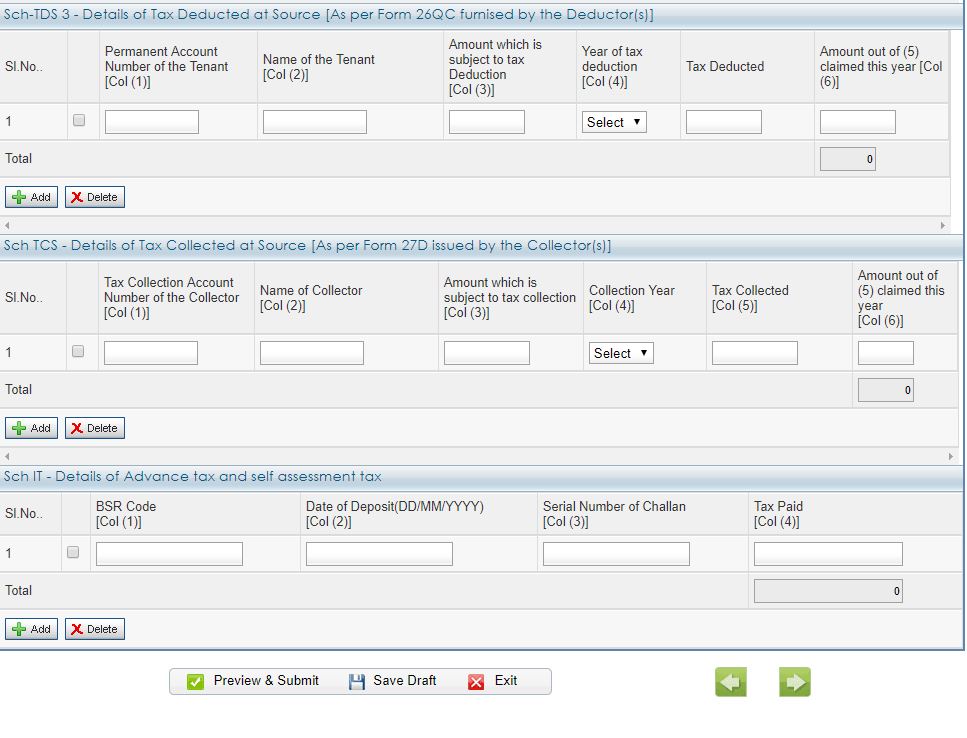

- Next step, select Computation of Income and tax, fill your details, like Income from salary their allowance and perquisites, Income from House property, Municpal taxes paid or Interest on home loan etc, Income from other Sources etc.-

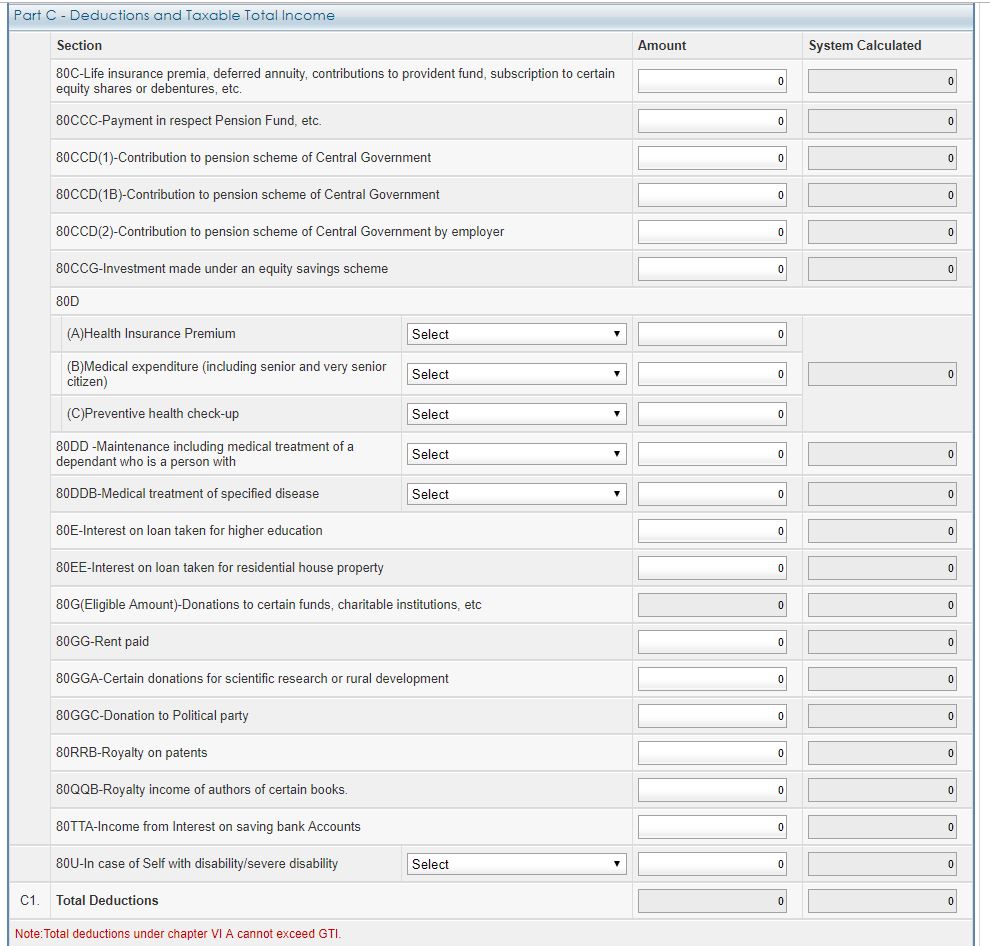

- Next, fill your details like Investments under section 80C, or any deduction (if any) shown below etc.-

- Next step, this is Auto fill -

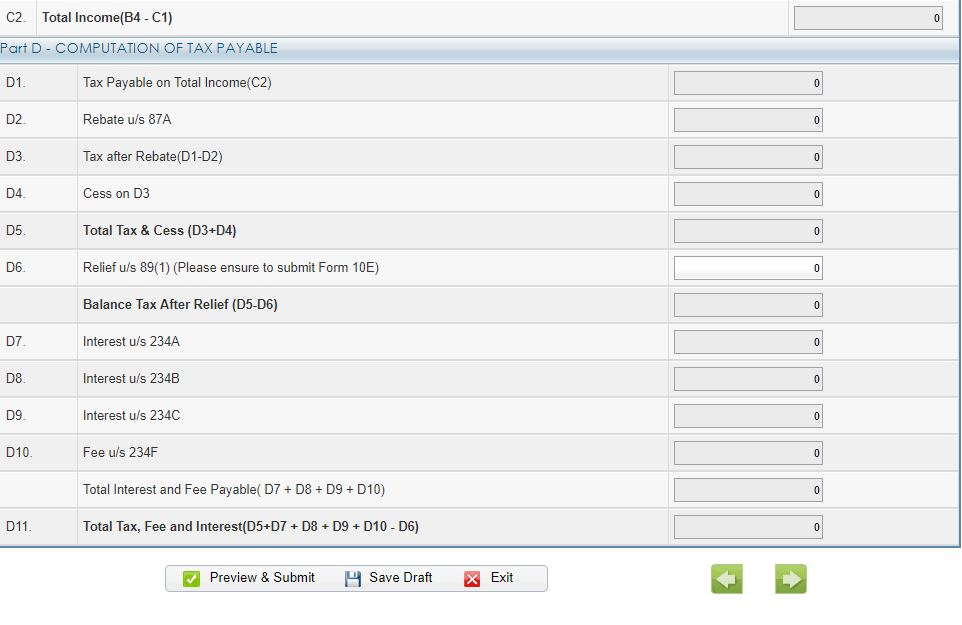

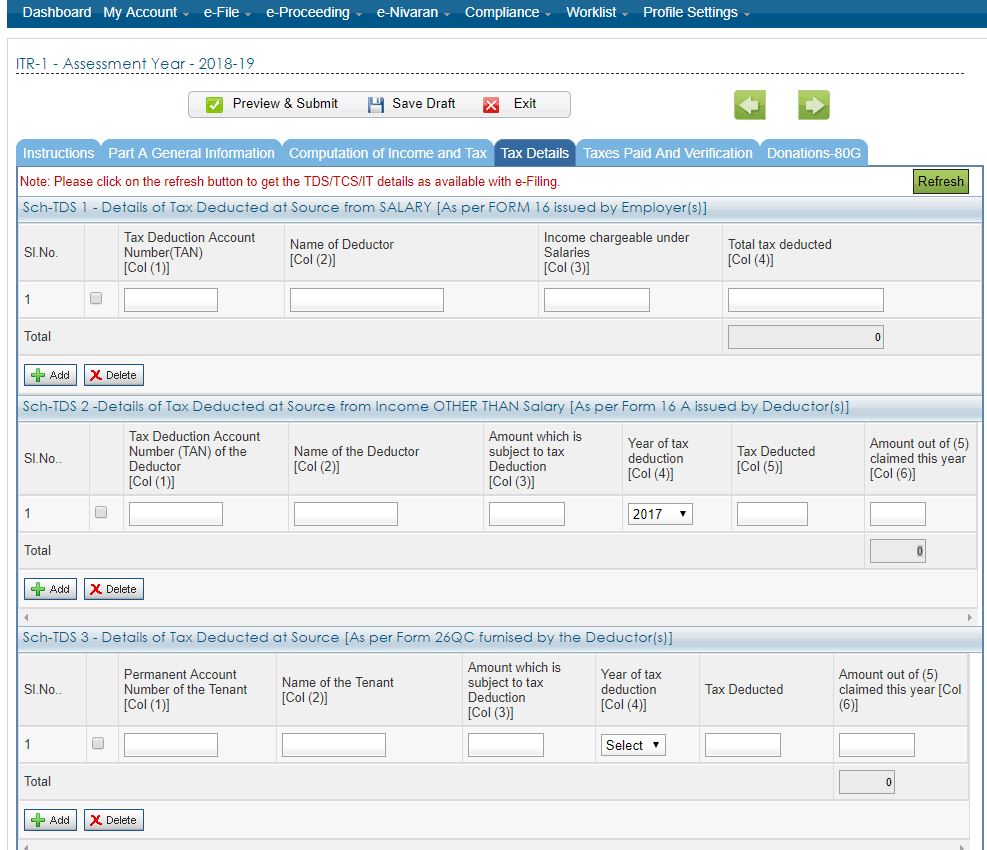

- Next step, fill the detail of TDS if not shown authomatic, enter the detail of Advance tax if any deposited during the financial year-

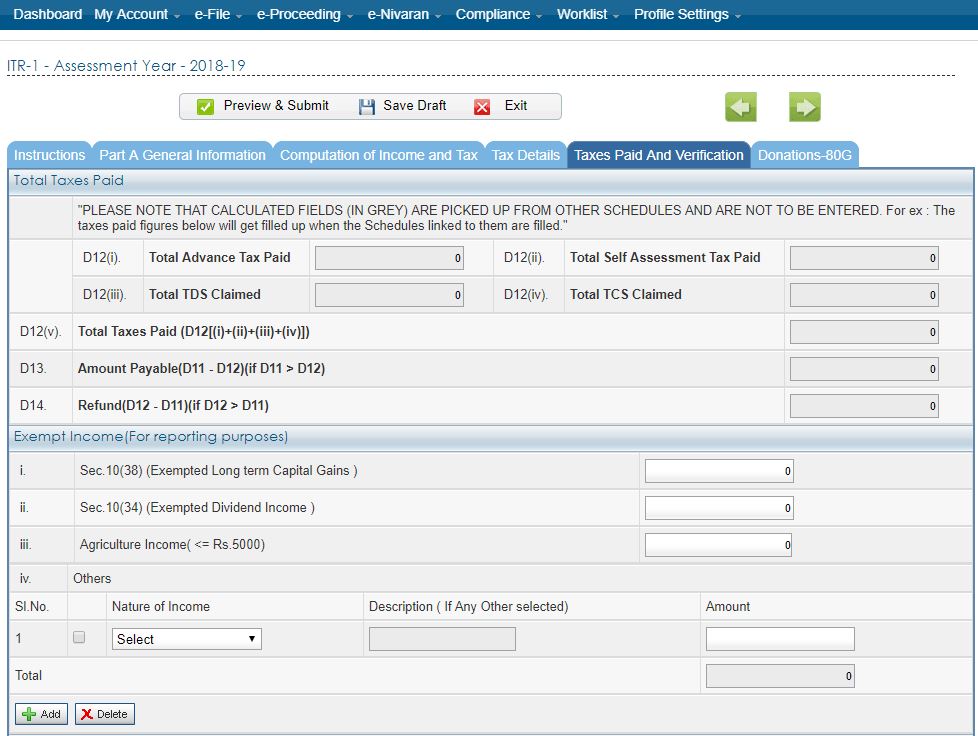

- Next step, after filing the details as above, the tax amount or refund if any will shown automatically, you have to fill the detail of exempted income (if any)-

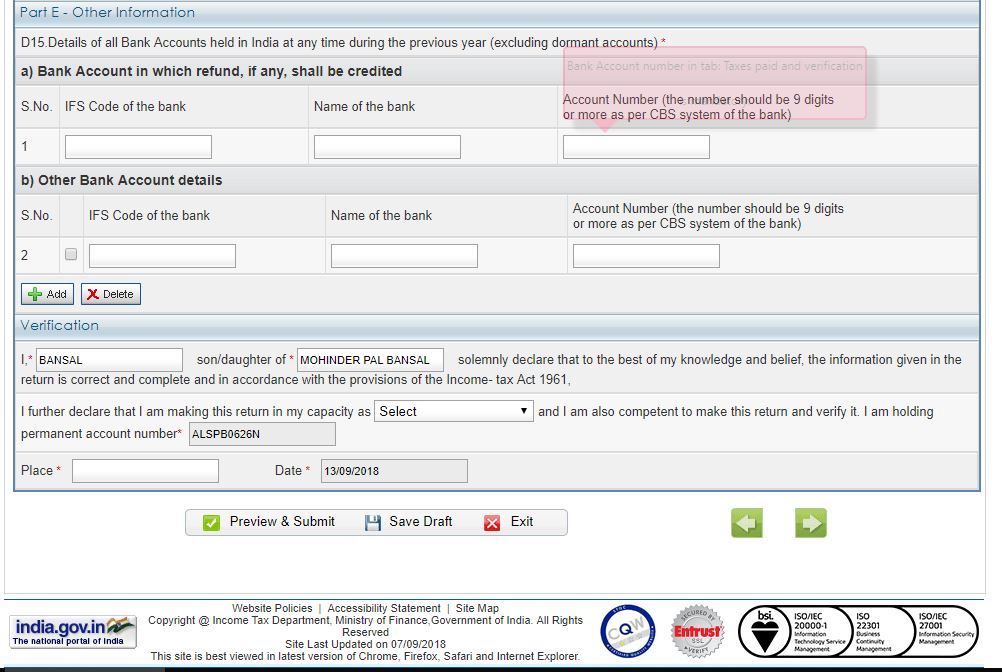

- Next, fill your bank details like Bank account number, IFSC Code etc., after that you have to go on verification select capacity as Individual or HUF or Authorised Signatory or Director, as the case may be-

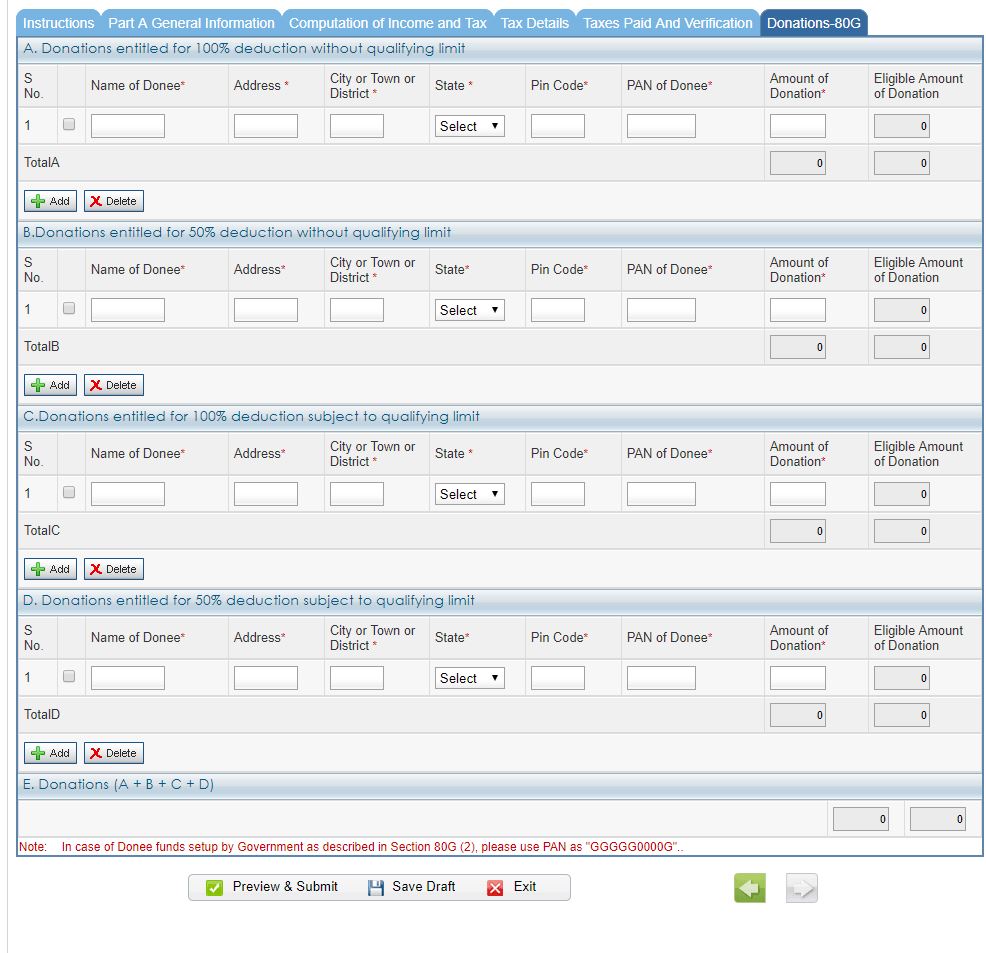

- Next step, fill the detail of donation if any paid, claim under section 80G-

After following the above process, save draft and then submit after preview the details filled by you and fill the OTP, which is displayed at your number, you must check that your Income tax return is filed.

© 2024 - EnSkyAR Financial Services