How to file form 15CA and 15CB

Introduction-

Here I am explaining about procedure for filing form 15CA & 15CB. These forms have been filed online through Income tax portal.

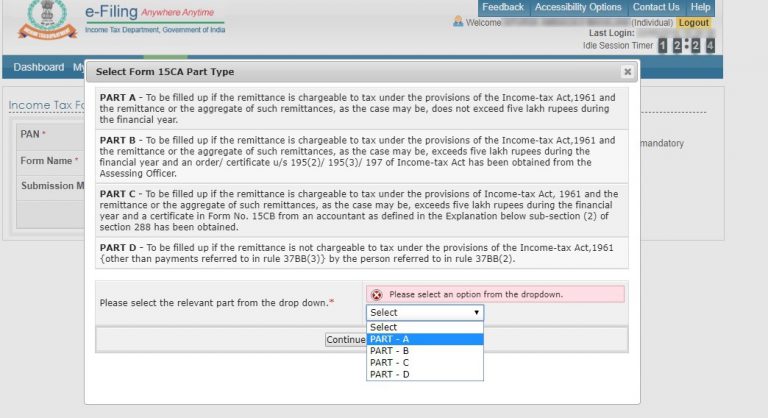

Form 15CA has 4 parts, but before filing Form 15CA (Part C), you have to required acknowledgement number of Form 15CB, which can be generated after filing Form 15CB.

Form 15CB has the certificate which is issued by the Chartered Accountant, contains the details about assessee. The Chartered accountant can filed the form 15CB online when the assessee add the name of the Chartered Accountant with their Membership number in Income tax portal.

The process how to file form 15CA & 15CB is as under-

A) The process how to file form 15CA-

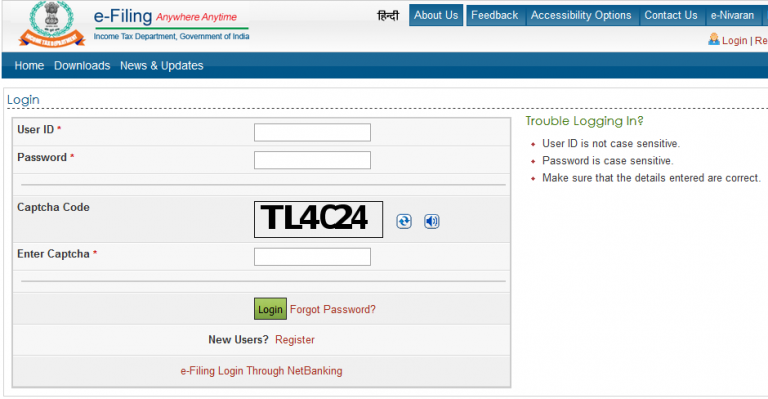

- Login to www.Incometaxindiaefiling.gov.in

- After “login the above link” enter the User ID, Password and Captcha as shown, in the screen display as below-

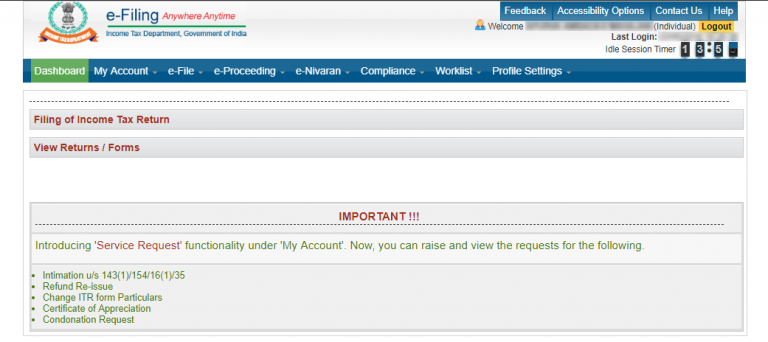

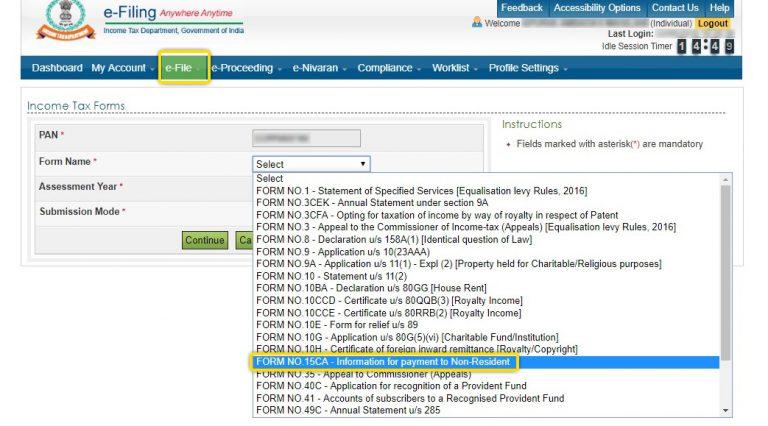

- Next, “Go to E-file” and “Click on Income Tax Forms” the screen will display as under-

- Next, “Select form 15CA” and go to submission mode and select “Prepare & Submit online” as the screen will display as under-

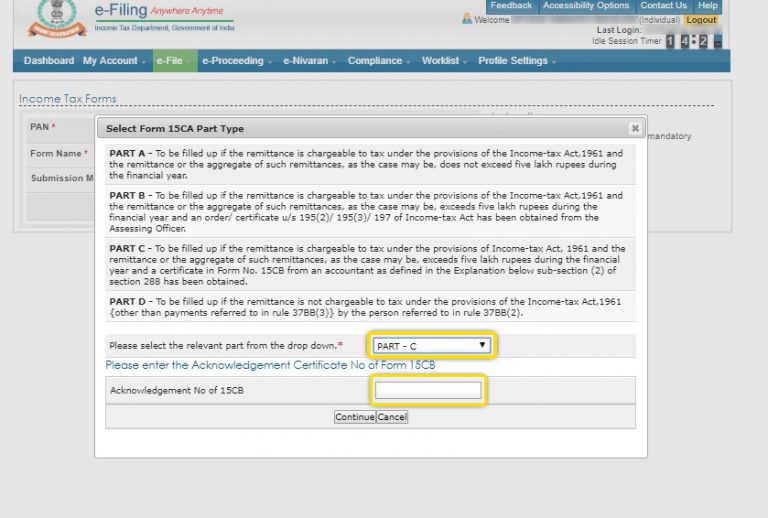

- Next, “Select Part A, B, C or D” as the case may be as the screen will display as under-

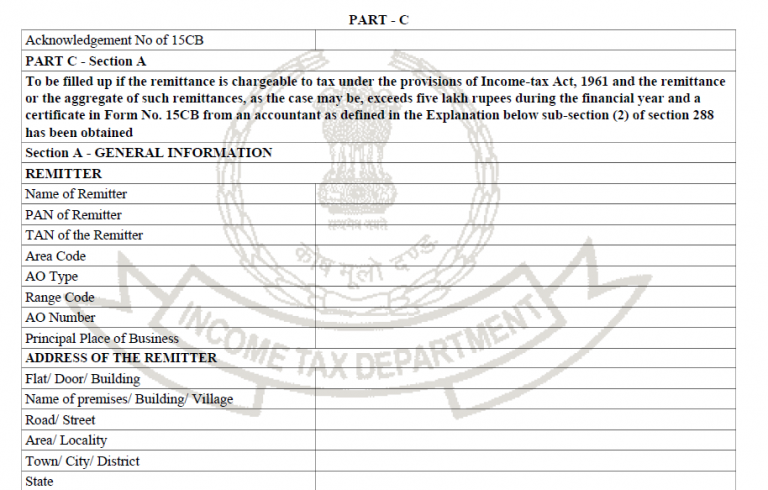

- Next, if you are filing “Part C of Form 15CA” always remember that “Form 15CB” uploaded first and its acknowledgement number is entered in “Part C of Form 15CA” then form 15CA will be submitted, as the screen will display as under-

- After submit the form 15CA (as the details shows as above) “Confirmation for submission” will be received.

Note-

Acknowledgement number of submitted Form 15CB is required for filing form 15CA (Part C).

B) The process how to file Form 15CB (by Chartered Accountant)-

- Login to www.Incometaxindiaefiling.gov.in

- After “Login the above link” click on “Downloads” as the screen will display as under-

- Next, Click on Other forms preparation utilities, as the screen will display as under-

- Next, download Form 15CB the Excel Utility or Java Utility, as the screen will display as under.

- Next, fill the details as required and “Generate XML file”

- Next, “Go to E-File” and “Upload the XML utility” which contains the details of PAN/TAN of assessee or Pan of Chartered Accountant and submit.

- Next, after submission the “Confirmation for Submission” will be received.

Note-

- It is mandatory to add the name of Chartered Accountant with their membership number on Income tax portal. After that the Chartered Accountant can file form 15CB.

- Digital Signature is Mandatory to file Form 15CB.