What is Income Tax refund-

When an assesse pays Advance tax or TDS deducted from their income which is excess from the income tax liability due at the end of any financial year is called excess of income tax deposited/deducted over his income tax liability called income tax refund. The income tax department always charged interest for late payment or pay interest on income tax refund.

An income tax refund can be taken back from the department after filing their income tax return. Every assesse has to file their income tax return even his income is below the taxable limit.

How Income Tax Refund does arises-

Income Tax refund occurred due to several scenarios as below-

- Excess amount paid in advance tax.

- TDS deducted or deposited by the bank against interest payment of FD etc., on the ground of non-submission of form G or form H

- Excess amount of TDS deducted or deposited by an employer for non-submission or late submission of declaration under income tax (for example HRA Exemption, Deductions under section 80 etc.)

- TDS deducted and deposited by payer against payment paid.

Keep in mind when filing your Income tax return-

Before filing your income tax return you have to check your bank details like bank account number or IFSC code etc. surely, because the refund will be credited in your bank directly.

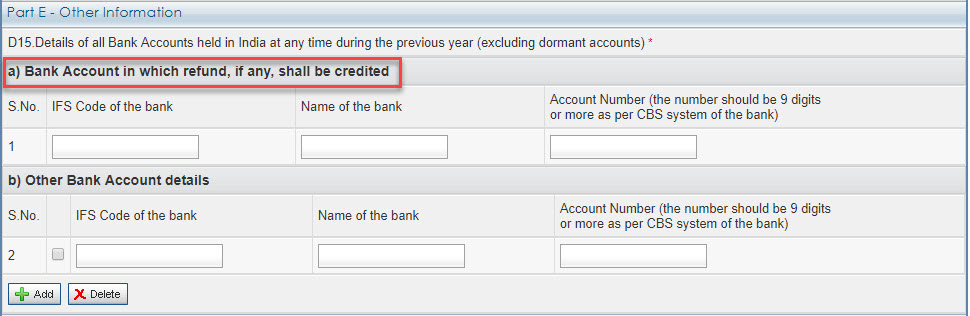

The details should be filed In section 'Tax paid and verification' section, Part E 'Other information' of income tax return, the annexure will display as under-

Step by step guide about how to check income tax refund-

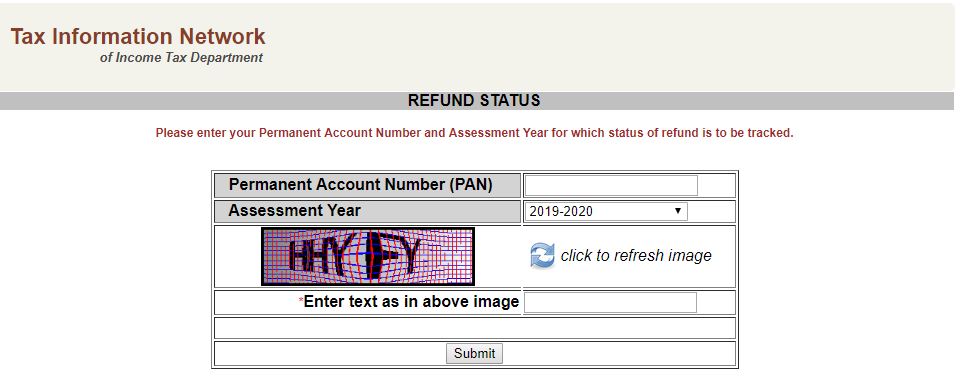

- Go to NSDL website or the said link https://tin.tin.nsdl.com/oltas/refundstatuslogin.html

- Next, the screen will display as below and filled the details like PAN, Assessment year or Captcha as shown below and submit-

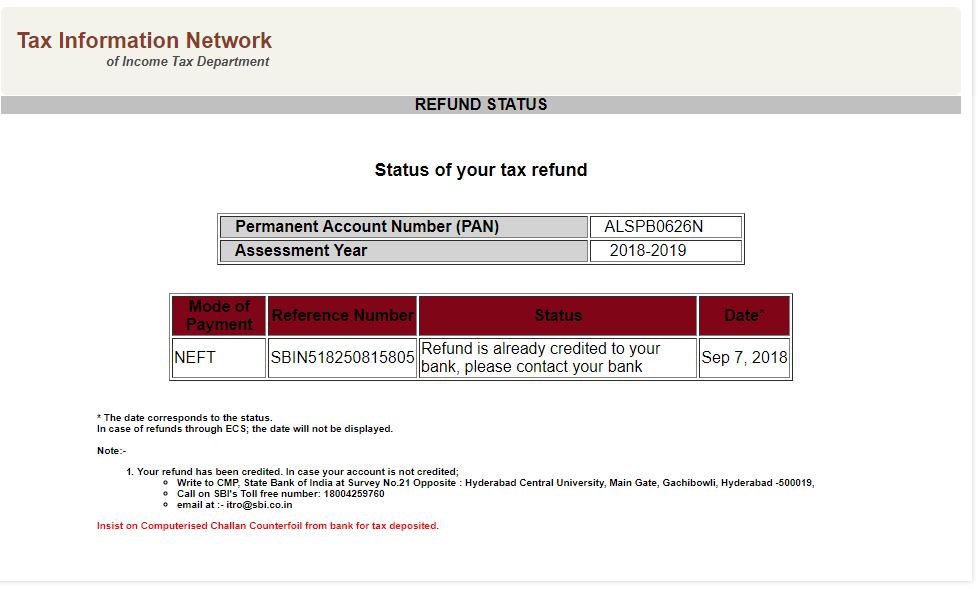

- In case refund is issued, the screen will display as under-

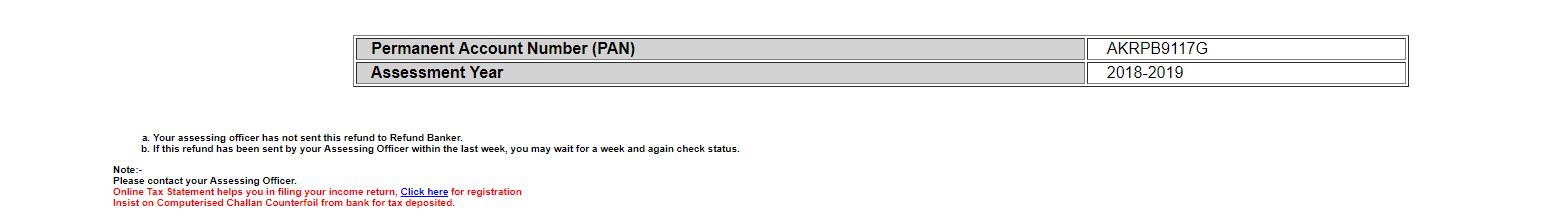

- In case refund is not issued, the screen will display as under-

Refund Banker

The 'Refund Banker Scheme,' which commenced from 24th Jan 2007, is now operational for taxpayers assessed all over India (except at Large Taxpayer Units) and for returns processed at CPC (Centralized Processing Centre) of the Income Tax Department at Bangalore.

In the 'Refund Banker Scheme' the refunds generated on processing of Income tax Returns by the Assessing officers/ CPC-Bangalore are transmitted to State Bank of India, CMP branch, Mumbai (Refund Banker) on the next day of processing for further distribution to taxpayers.

Refunds of Income tax can be received by following two modes-

- RTGS / NECS: To enable credit of refund directly to the bank account, Taxpayer.s Bank A/c (at least 10 digits), MICR code of bank branch and correct communication address is mandatory.

- Paper Cheque: Bank Account No, Correct address is mandatory.

Taxpayers can view status of refund 10 days after their refund has been sent by the Assessing Officer to the Refund Banker - by entering 'PAN' and 'Assessment Year'