Introduction-

Residential status of a Firm or an Association of Person or a company is to be determined for Income Tax purpose. In case of resident of India, they have to pay taxes to the Income Tax Department and if not, then they have not liable to pay any taxes to the aforesaid authority. So to calculate tax as per Income Tax Act, we have to determine the residential status.

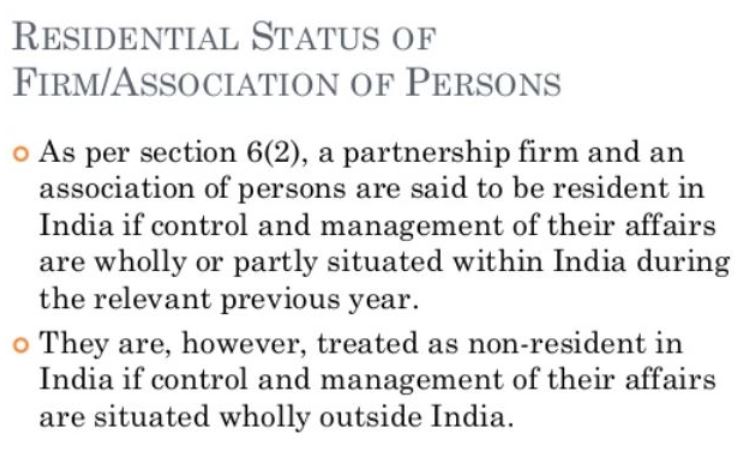

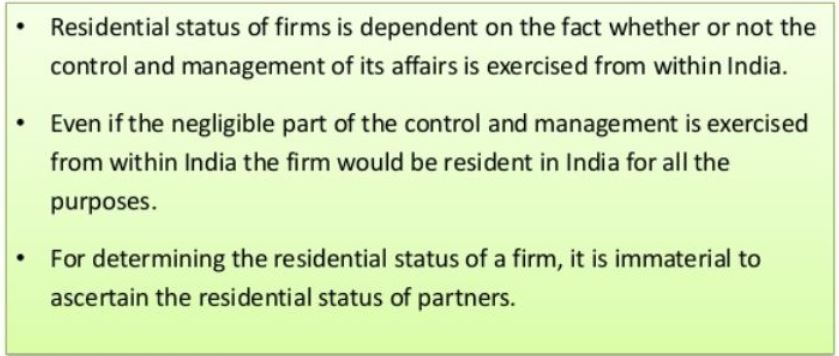

(1) In Case of Firm, AOP or BOI etc. {Section 6 (2) and 6(4)}-

(i) A Firm, AOP or BOI is said to be “Resident” in India-

Firm, AOP or BOI etc. is said to be resident in India in any previous year in every case except where during that year the control and management of its affairs is situated wholly outside India

(ii) A Firm, AOP or BOI is said to be Non Resident-

If the control and management of the affairs of these entities is wholly out of India during the relevant previous year then they are said to be non-resident.

Note -

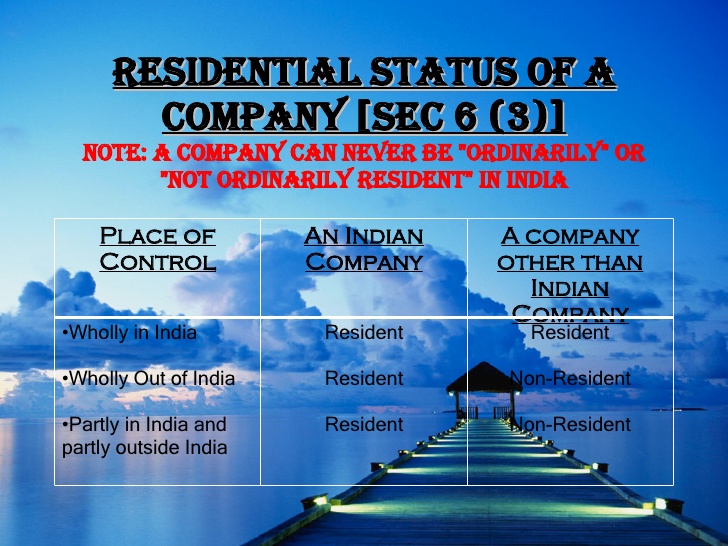

(2) In Case of Company {Section 6(3)}-

A company is said to be a resident in India in any previous year, if—

(i) it is an Indian company; or

(ii) its place of effective management, in that year, is in India.

w.e.f. 1st April 1st 2016 (FY 2016-17), the residential status of companies which are not incorporated under the corporate laws of India, would be determined by the concept of “POEM”

Explanation—For the purposes of this clause "place of effective management" means a place where key management and commercial decisions that are necessary for the conduct of business of an entity as a whole are, in substance made.]

(i) Indian Company {Section 6(3) (i)}-

An Indian company is always resident in India. Even if an Indian company is controlled from a place located outside India (or even if shareholders of an Indian company controlling more than 51 per cent voting power are non-resident and/or located outside India), the Indian company is resident in India. An Indian company can never be non-resident.

(ii) Foreign Company {Section 6(3) (ii)}-

A foreign company (whose turnover/gross receipt in the previous year is more than Rs. 50 crore)- It will be resident in India if its place of effective management (POEM), during the relevant previous year, is in India.

(iii) Foreign Company {Section 6(3) (iii)}-

Provisions of section 6(3)(ii) shall not apply to a foreign company having turnover or gross receipts of Rs. 50 crore or less in a financial year – Circular No. 8/2017, dated February 23, 2017. A Foreign Company (whose turnover/gross receipt in the previous year is Rs. 50 crore or less) - is always non-resident in India.