Introduction-

The following additions/changes have made in Income Tax Returns for the A.Y. 2019-20 as compared to previous year vide notification no. 32/2019 dated 01.04.2019-

Major Changes-

- Aadhar Number is mandatory for filing Income Tax Return for the A.Y. 2019-20

- Every person has to file their income tax return online only except super senior citizens having the age of above 80 years i.e. Super senior citizens can file their return in paper form.

- If TDS Deducted under section 194-IB, under Income from House Property-Furnish the PAN of the Tenant is mandatory

- If TDS Deducted under section 194I- Furnish the TAN of the Tenant is mandatory

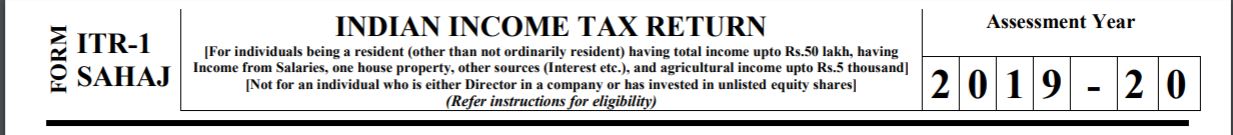

Changes in ITR-1

For individuals being a resident (other than not ordinarily resident) having total income up to Rs.50 lakh, having Income from Salaries, one house property, other sources (Interest etc.), and agricultural income up to Rs.5 thousand].

- It is not applicable for an Individual who is either Director in a company or has invested in unlisted equity share-

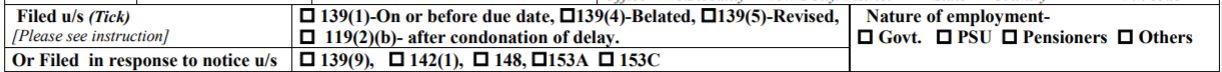

- Provide additional details of nature of employment i.e. Pensioners-

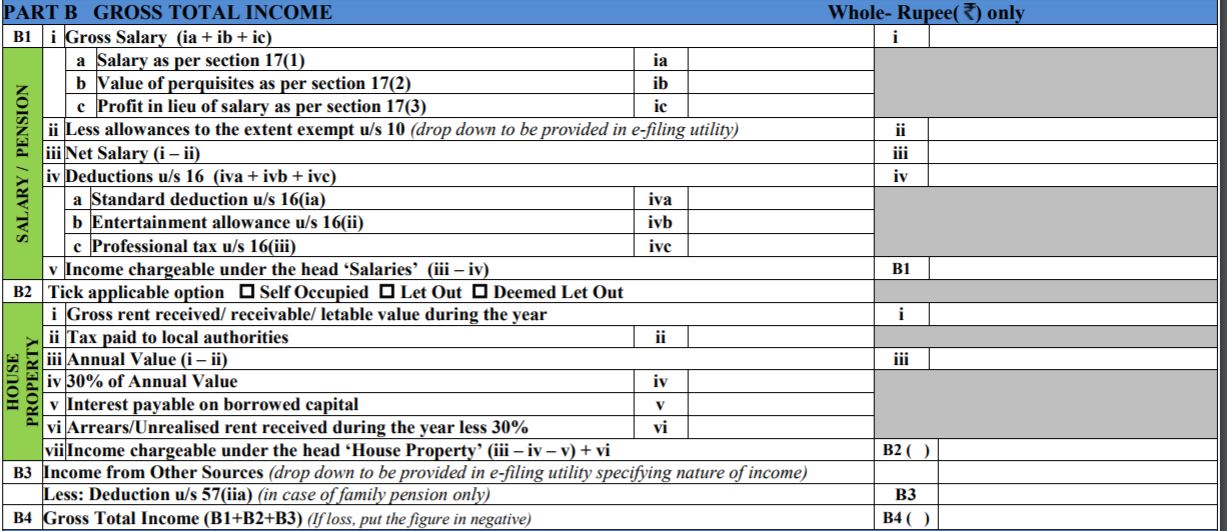

- Allowed Standard Deduction

- Provide details about Allowances exempt under section 10-

- Provide nature of income under the head “Income from Other Sources”-

- Show separately deduction u/s 57 (iia), (In case of family pension only)-

Changes in ITR-2

For Individuals and HUFs not having income from profits and gains of business or profession-

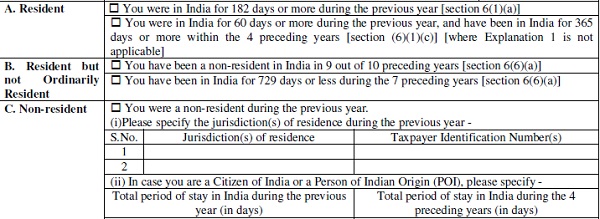

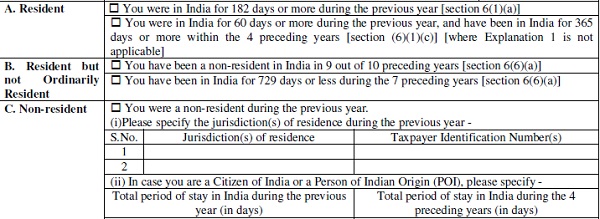

- Provide additional detail regarding “Residential Status”-

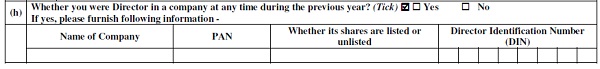

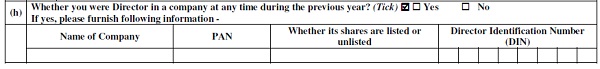

- Provide details about Directorship in any company i.e. Name of the company their PAN, DIN number and whether the shares are listed or unlisted etc.-

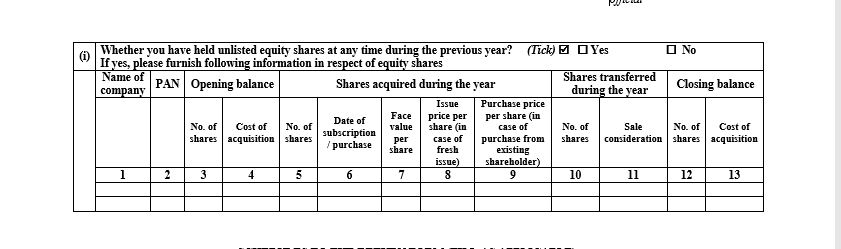

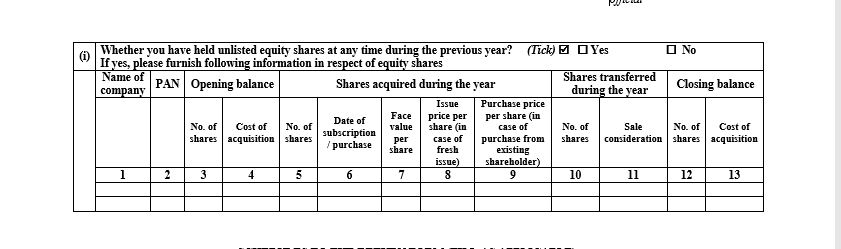

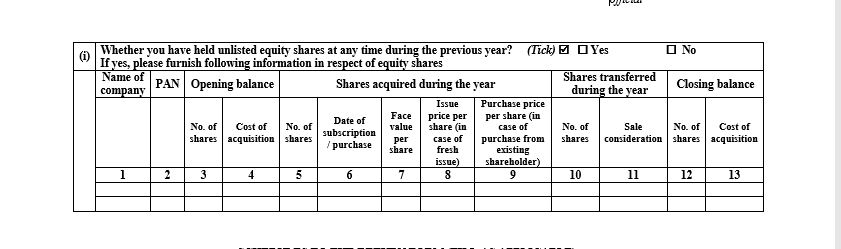

- Provide details regarding holding of unlisted equity shares at any time during the previous year-

- A person whose agricultural income exceeds Rs. 5.00 lakh has provided the additional details.

Changes in ITR-3

For individuals and HUFs having income from profits and gains of business or Profession-

- Provide additional detail regarding “Residential Status”-

- Provide details about Directorship in any company i.e. Name of the company their PAN, DIN number and whether the shares are listed or unlisted etc.-

- Provide details about holding of unlisted equity shares at any time during the previous year-

- Profit & Loss account is divided into parts i.e. “Part A- Manufacturing Account, Trading Account & P & L Account” with their detailed information.

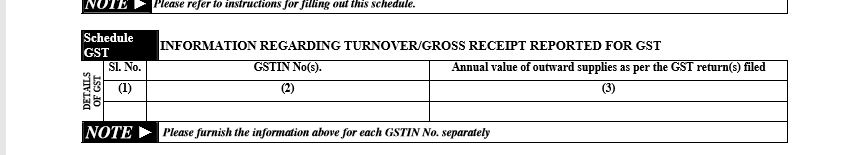

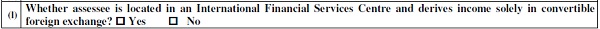

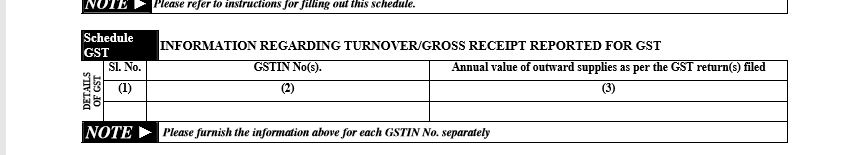

- Schedule GST – Information regarding turnover / gross receipts reported for GST included (earlier it was in ITR-4)-

- This form can be used to declare the income calculated under presumptive taxation scheme under section 44AD,44ADA,44AE

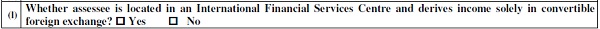

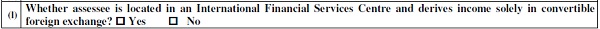

- Whether located in an International Financial Service Centre and derives income solely in convertible foreign exchange-

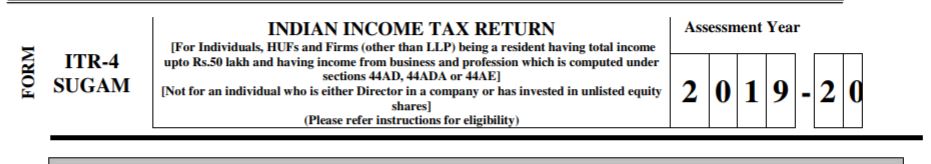

Changes in ITR-4

For Individuals, HUFs and Firms (other than LLP) being a resident having total income up to Rs.50 lakh and having income from business and profession which is computed under sections 44AD, 44ADA or 44AE]-

- This form is not for an Individual who is either Director in a company or has invested in unlisted equity shares-

Changes in ITR-5

For persons other than, - (i) individual, (ii) HUF, (iii) company and (iv) person filing Form ITR-7]-

- Provide details of holding of unlisted equity shares at any time during the previous year-

- Whether located in an International Financial Service Centre and derives income solely in convertible foreign exchange-

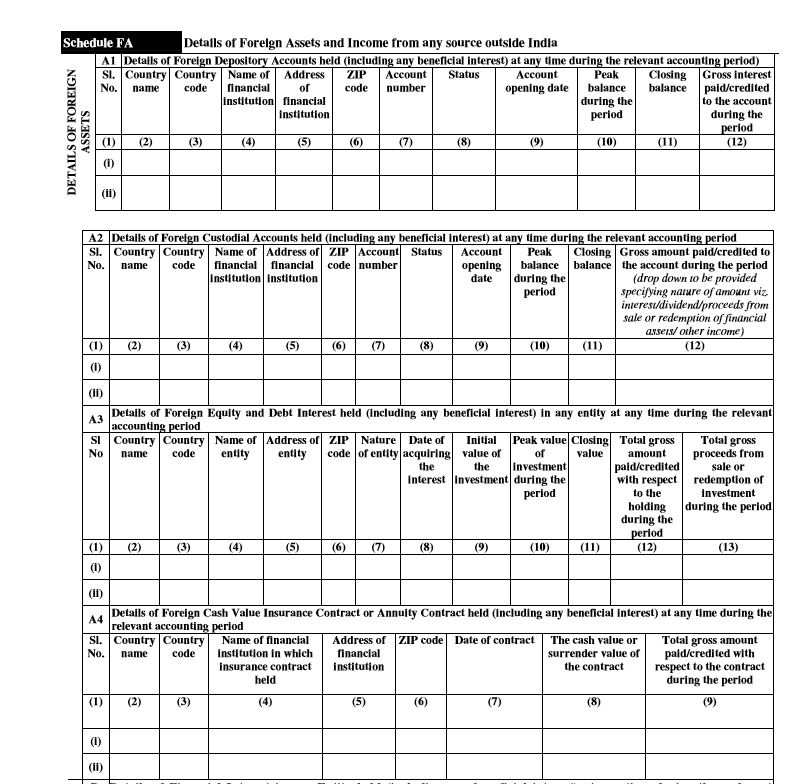

- Provide complete details of Foreign Assets and Income from any source outside India-

Changes in ITR-6

For Companies other than companies claiming exemption under section

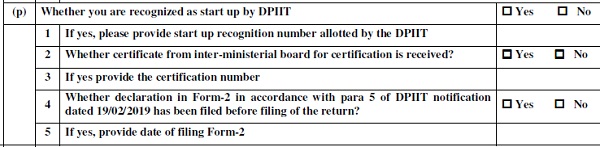

- Provide detail about startups-

- Whether located in an International Financial Service Centre and derives income solely in convertible foreign exchange-

- Schedule GST – Information regarding turnover / gross receipts reported for GST included (earlier it was in ITR-4)-

- Provide complete details of Foreign Assets and Income from any source outside India-

Changes in ITR-7

For persons including companies required to furnish return under sections 139(4A) or 139(4B) or 139(4C) or 139(4D)-

- Provide complete details of Foreign Assets and Income from any source outside India-

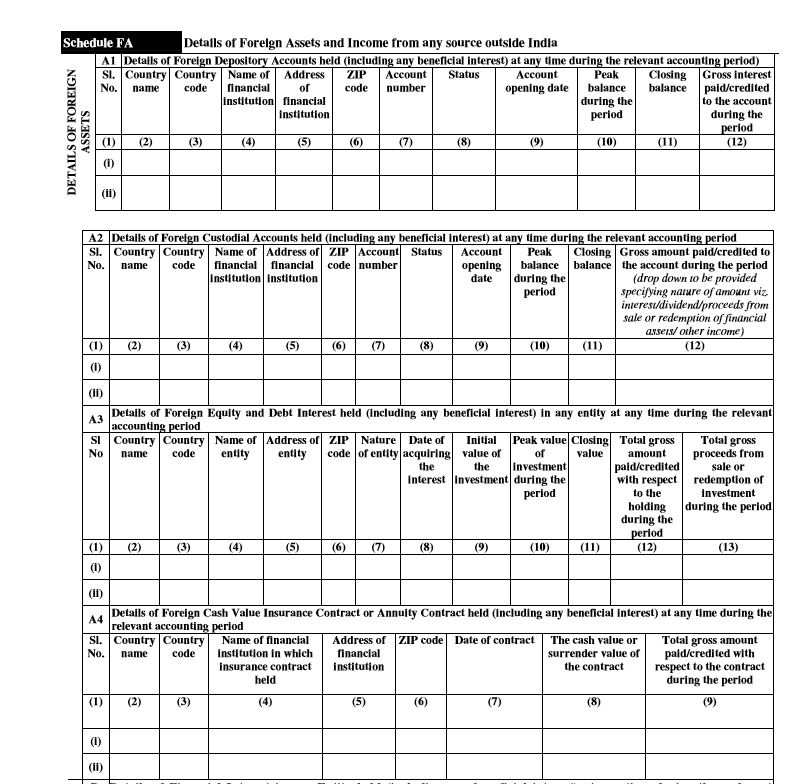

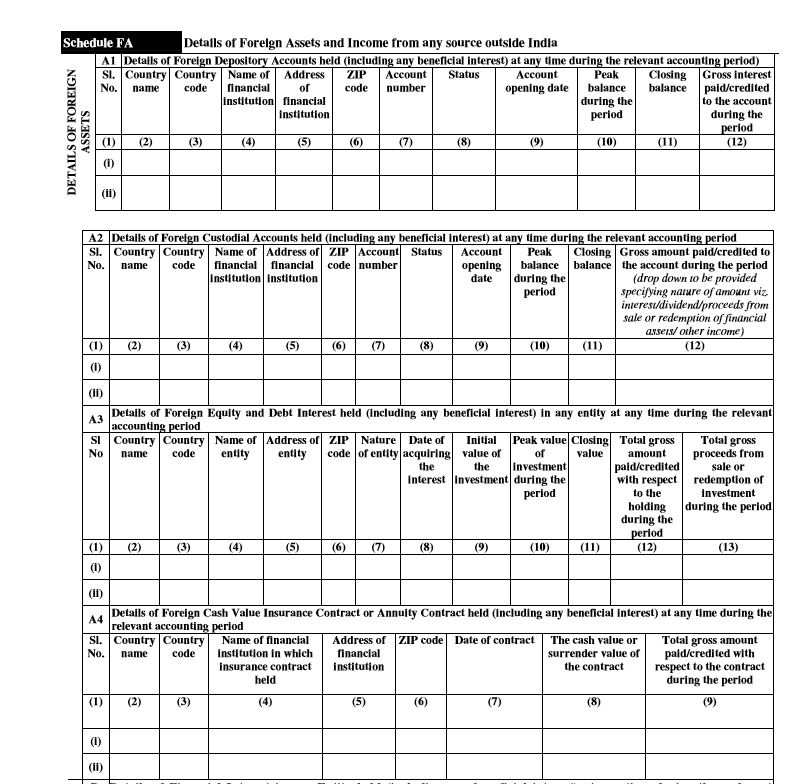

Schedule FA – Details of Foreign Assets and Income from any source outside India in ITR 5, 6 & 7

– A1: Details of Foreign Depository Accounts held (including any beneficial interest) at any time during the relevant accounting period

– A2: Details of Foreign Custodial Accounts held (including any beneficial interest) at any time during the relevant accounting period

– A3: Details of Foreign Equity and Debt Interest held (including any beneficial interest) in any entity at any time during the relevant accounting period

– A4: Details of Foreign Cash Value Insurance Contract or Annuity Contract held (including any beneficial interest) at any time during the relevant accounting period