How to check the status of TDS Challan deposited

How to downloand the CSI file or status of TDS Challan deposited into the bank-

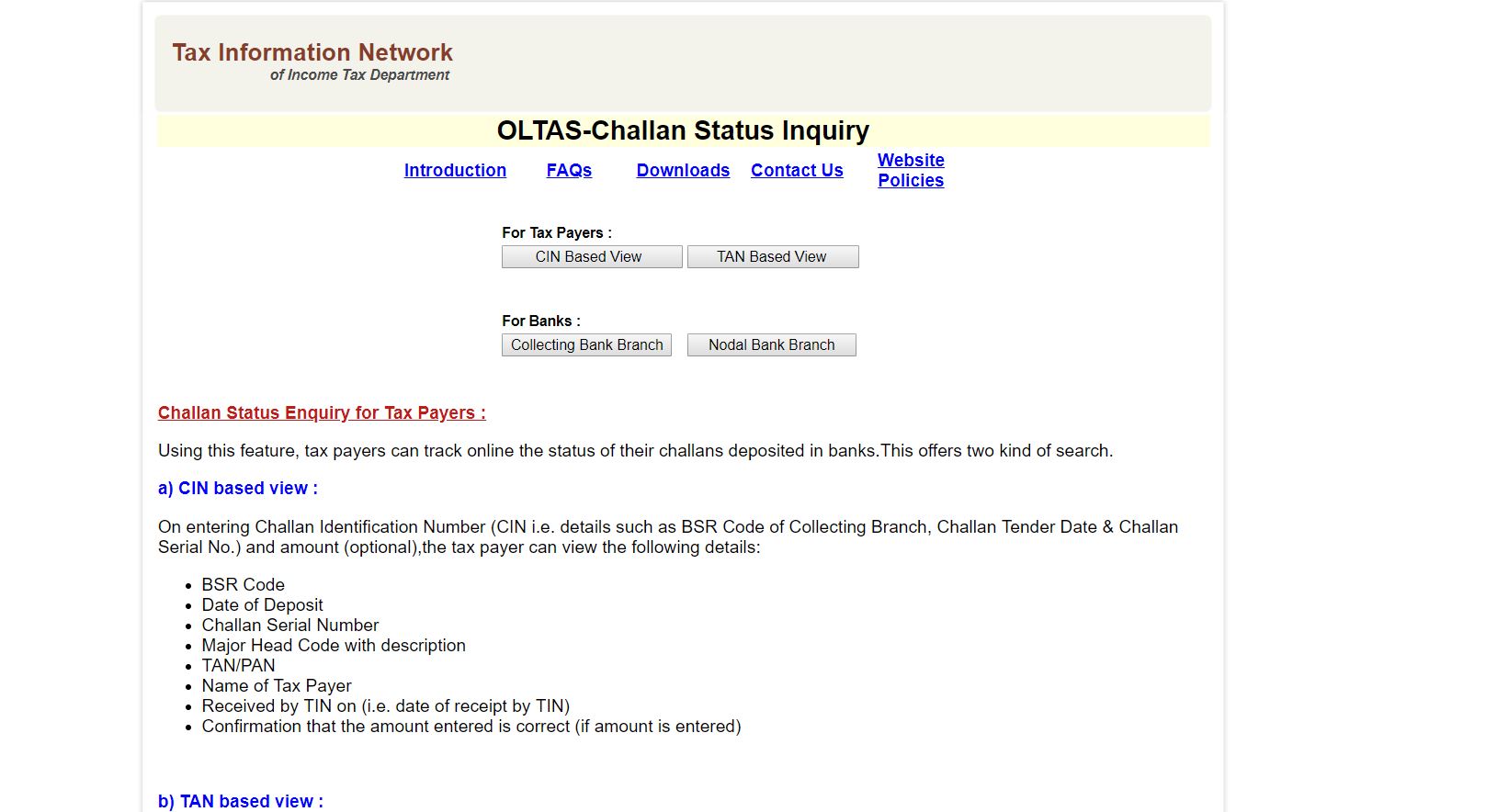

Challan Status Enquiry for Tax Payers-

- Login on https://tin.tin.nsdl.com/oltas/servlet/QueryTaxpayer, the screen will be displayed as under-

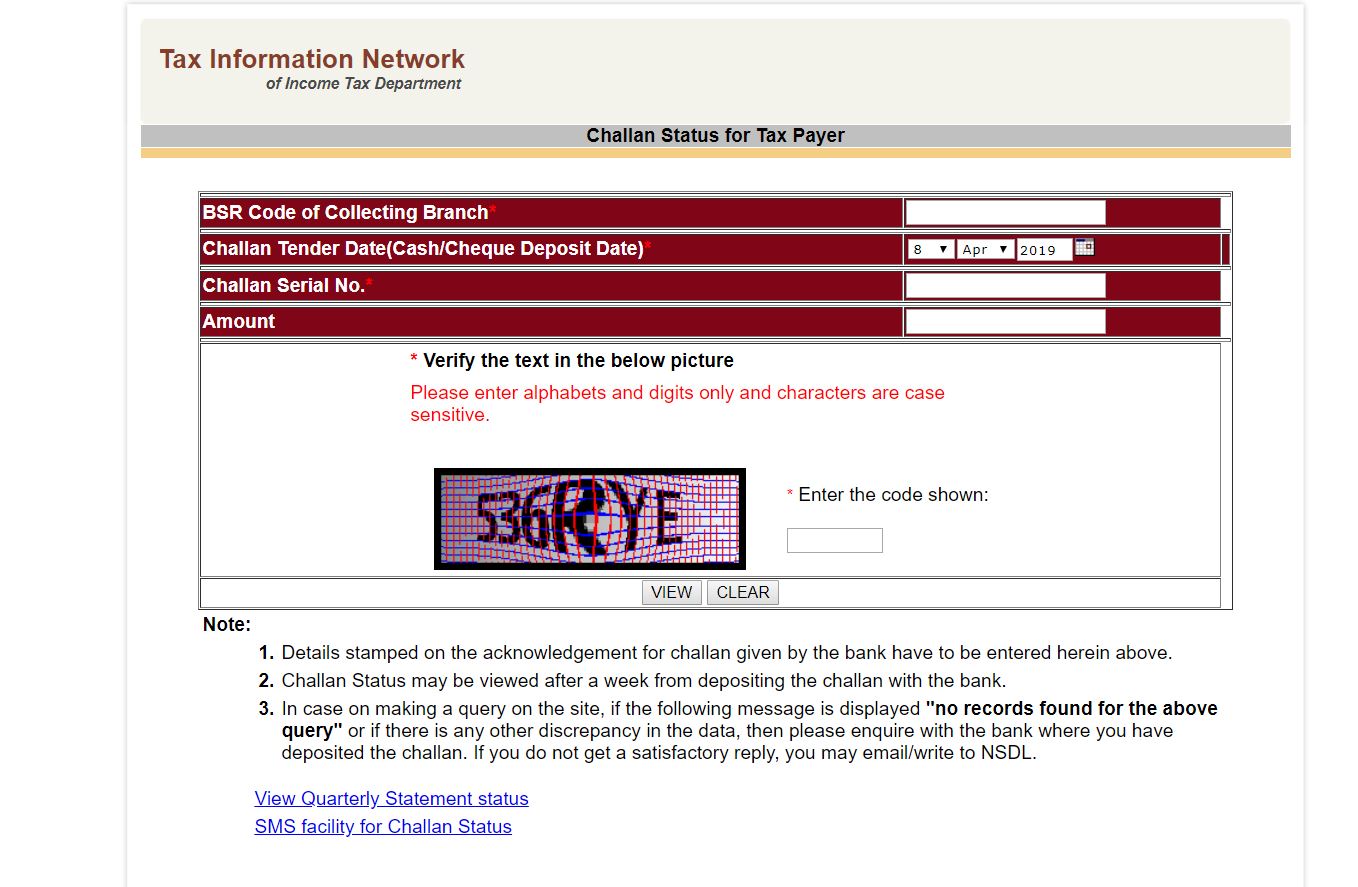

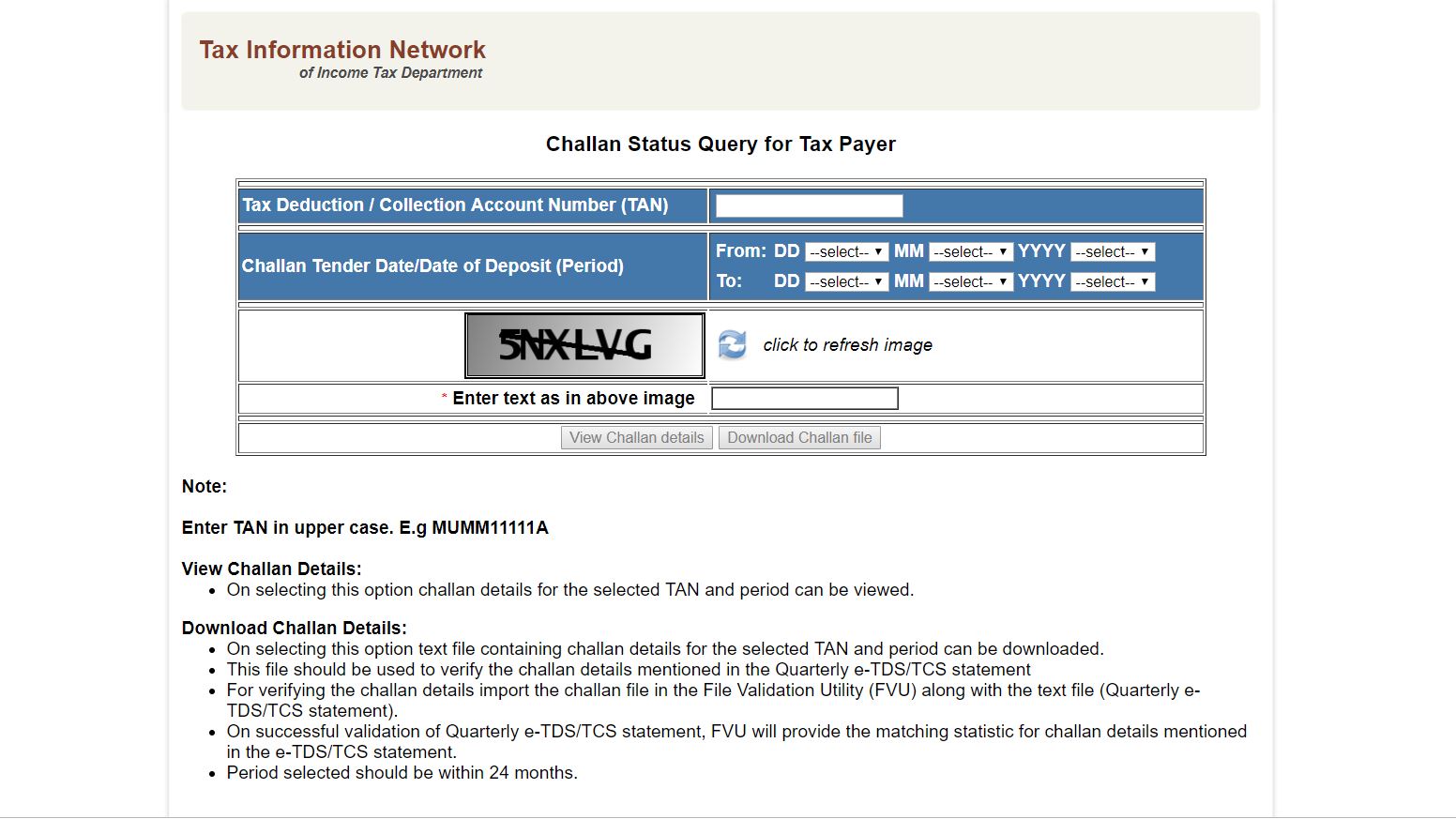

- Next step, then, select either from CIN (Challan Identification Number) based view or TAN based view, as the screen will be displayed as below-

CIN based view-

TAN based view-

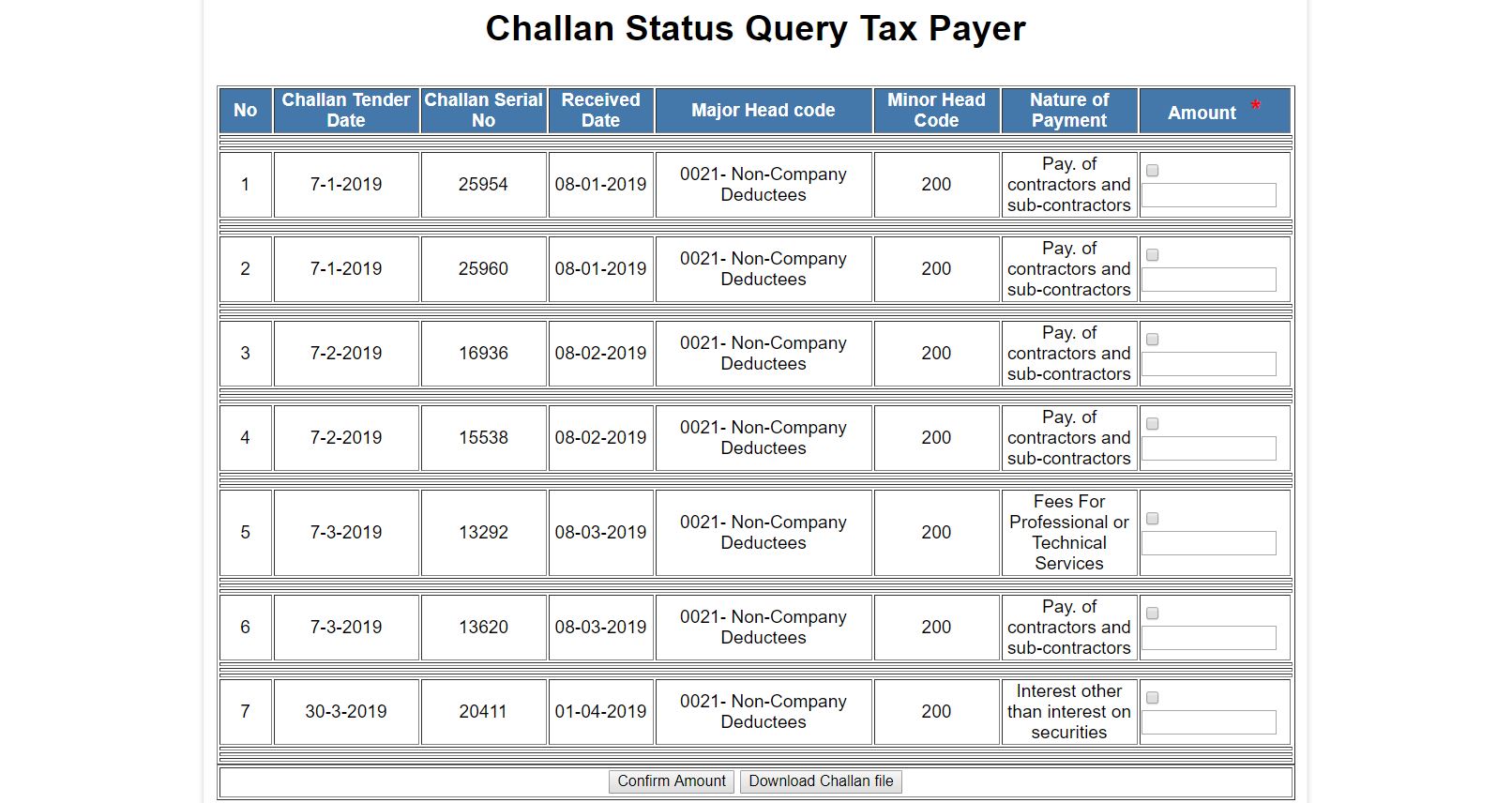

- Next step, then, fill the requisite details in order to view the Status, the screen will be displayed as below-

- Next step, then, the tax deductor may download the Challan details file for a selected period through TAN based view, as display above, which shall be further used to verify the Challan entries filed in the e-TDS/TCS Statement-

Challan Status for Bank Branch-

A) Collecting Bank Branch-

On providing the branch scroll date and the major head code - description, the tax collecting branch can access the total amount and total number of challans for each major head code. Further, the collecting branch can view following details:

- Challan Serial Number

- Challan Tender Date

- PAN/TAN

- Name of Taxpayer

- Amount

- Date of receipt by TIN

B) Nodal Bank Branch -

On providing the nodal scroll date and the major head code-description, the nodal branch can view the following details:

- Nodal Branch Scroll Number

- Scroll Date

- Major Head Code – Description

- Total Amount

- Number of Branches

- Number of Challans

Further, for each Nodal Branch Scroll Number, following information can be accessed:

- BSR Code

- Branch Scroll Number

- Branch Scroll Date

- Total Amount

- Number of Challans

- Date of receipt by TIN