Introduction-

After death of any person during the financial year, it is compulsory to file income tax return or paid taxes( if any), of the deceased assessee, for the period up to the death of the person.

Who is liable to file Income tax return or pay taxes -

“Legal Heir” of the deceased person is responsible for filing an income tax return or pay taxes on behalf of the deceased person up to the date of death of the person, there after the income of deceased person will be income of “Legal Heir”.

For Example-

Mr. X has rental income of Rs. 50,000 per month, he was expired on 28.11.2018. Who will be responsible for filing ITR on behalf of Mr. X. How much amount is including in income of Mr. X and who is paying taxes after that income?

Answer-

“Legal Heir” of Mr. X, is responsible for filing an ITR on behalf of Mr. X after his death and there after the income of Mr. X will be income of his legal heir.

Income of Mr. X for the financial year 2017-18-

Rental Income = Rs. 50,000 x 8 months (i.e. for 8 months from April’17 to November’17) = Rs. 4,00,000

Income of “legal heir” will be from November 2017 onwards-

Rental Income = Rs. 50,000 x 4 months (i.e. for 4 months from December’17 to March’18) = Rs. 2,00,000

Procedure, how to register as “Legal Heir”-

- Login to https://www.incometaxindiaefiling.gov.in

- Next step, – Login to e-filing portal using legal heir credentials

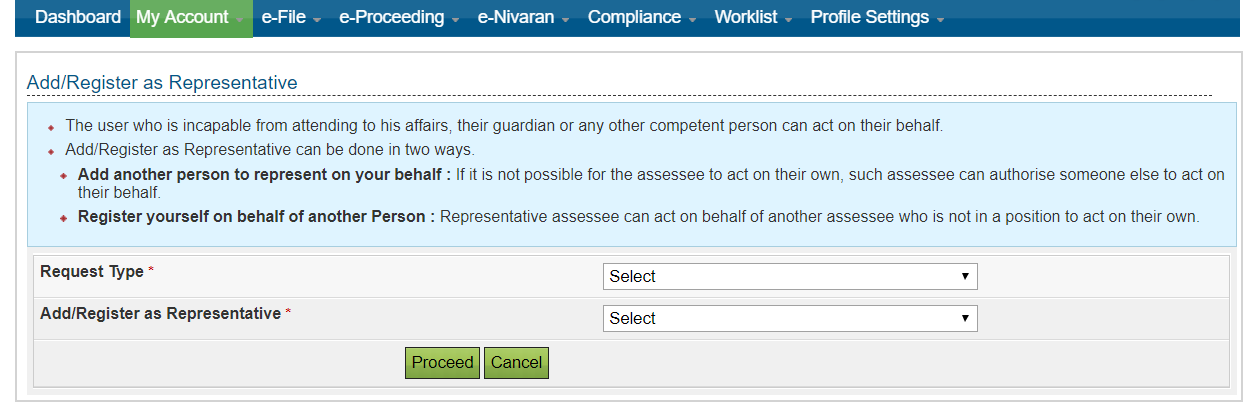

- Next step, – Go to My Account and register as Representative, as the screen will be displayed as under-

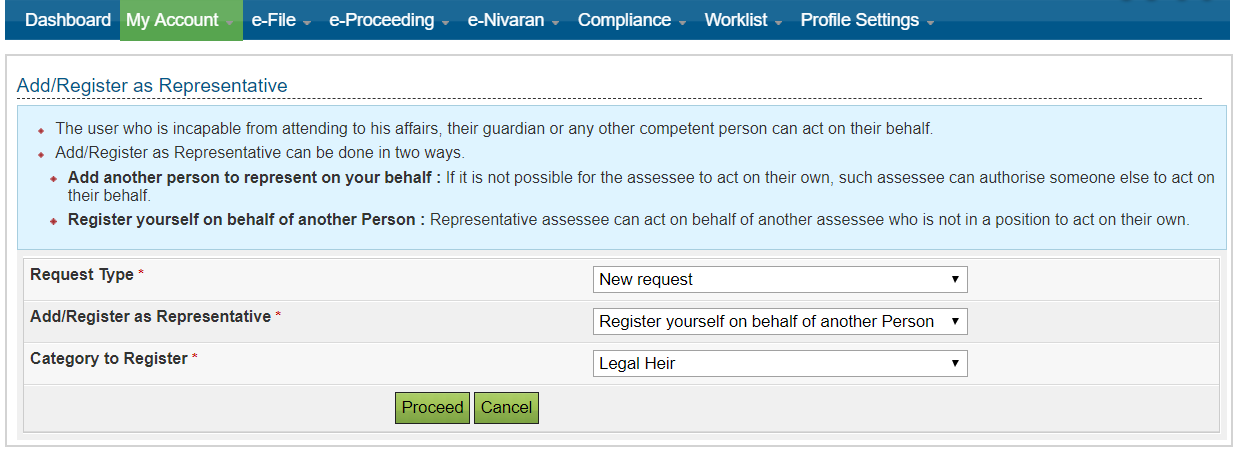

- Next step, – the screen will be displayed as under and fill the following details-

(i) Select the type of Request – New Request

(ii) Select the Add/Register as representative – “Register yourself on behalf of another person”.

(iii) Select the category to register as Estate of deceased.

- Next step,

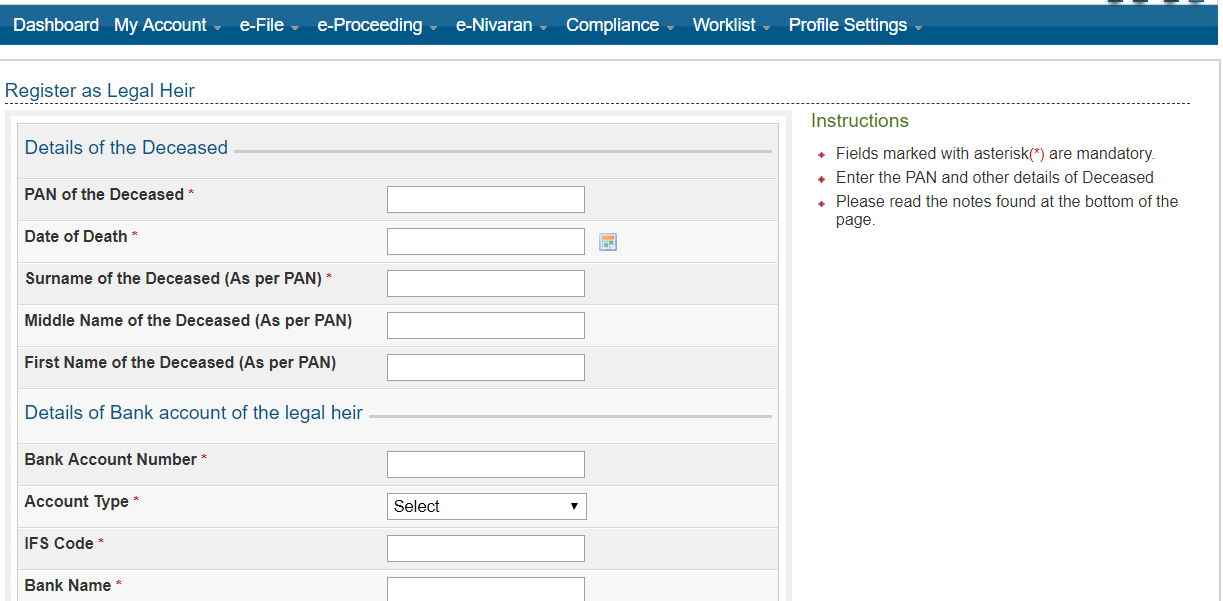

the screen will be displayed as under, fill the following details in the page appeared:

Documents required are as follows:

- Copy of Death Certificate

- Copy of the PAN Card of the deceased

- Self-Attested PAN card Copy of the Legal heir

- Legal Heir Certificate.

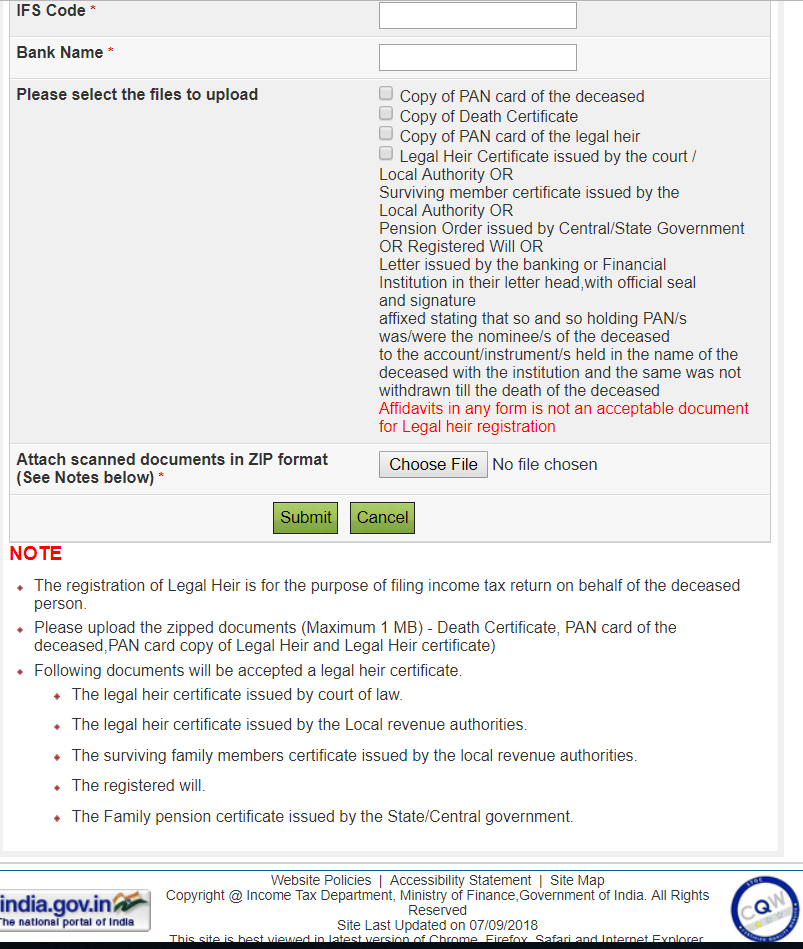

To register as legal heir, any of the following documents are accepted as legal heir certificates:

- The legal heir certificate issued by the court of law

- The legal heir certificate issued by the Local revenue authorities.

- The certificate of the surviving family members issued by the local revenue authorities.

- The registered Will of the deceased person

- The family pension certificate issued by the State/Central government.

After submission of the above documents, a request would be sent to the income tax authorities and after reviewing these documents, they will accept/reject the application. An email is sent to the registered email id with the details of approval/rejection.

Refund of income tax

The Income Tax Act follows the same provisions as above in case of refund amount (in case it is due). It is advisable to get the refund amount in a joint account. If the deceased tax payer holds a joint account with the legal heir, then it becomes convenient to receive the amount. In case of absence of a joint account, the account can be operated by the nominee who is appointed by the deceased. In the absence of a nominee, the legal heir can operate the account.